The Index of Economic Freedom provides compelling evidence of the wide-ranging tangible benefits of living in freer societies. Now in its 23rd edition, the Index analyzes economic policy developments in 186 countries. Countries are graded and ranked on 12 measures of economic freedom that evaluate the rule of law, government size, regulatory efficiency, and the openness of markets.

Key Findings of the 2017 Index

- Per capita incomes are much higher in countries that are more economically free. Economies rated “free” or “mostly free” in the 2017 Index generate incomes that are more than double the average levels in other countries and more than five times higher than the incomes of people living in countries with “repressed” economies.

- Not only are higher levels of economic freedom associated with higher per capita incomes, but greater economic freedom is also strongly correlated to overall well-being, taking into account such factors as health, education, environment, innovation, societal progress, and democratic governance.

- No matter what their existing level of development may be, countries can get an immediate boost in their economic growth by implementing steps to increase economic freedom through policies that reduce taxes, rationalize the regulatory environment, open the economy to greater competition, and fight corruption.

The Growth of Economic Freedom

- Economic freedom has advanced in a majority of the world’s countries over the past year. Global average economic freedom increased by 0.2 point to a record level of 60.9 on the 0–100 scale used in the Index of Economic Freedom. Since the inception of the Index in 1995, average scores have increased by over 5 percent.

- In the 2017 Index, 103 countries, most of which are less developed or emerging economies, showed advances in economic freedom. Remarkably, 49 countries achieved their highest economic freedom scores ever. Two large economies (China and Russia) are included in this group.

- While two countries (Mauritius and the United Kingdom) recorded no change in score, 73 experienced declines in economic freedom. Sixteen of these 73 countries, including notably the Bahamas, Bahrain, El Salvador, Pakistan, Venezuela, and the United States, recorded their lowest economic freedom scores ever.

- The Asia–Pacific region is home to nine of the 20 most improved countries: Fiji, Kiribati, Kazakhstan, China, Turkmenistan, Uzbekistan, Vanuatu, Tajikistan, and the Solomon Islands all recorded score gains of four points or more. On the other hand, Sub-Saharan Africa has the most countries (Cabo Verde, Djibouti, Ghana, Guinea, Kenya, The Gambia, and Madagascar) recording notable score declines, followed by the Americas (Barbados, the Bahamas, Venezuela, Suriname, Saint Lucia, and Brazil).

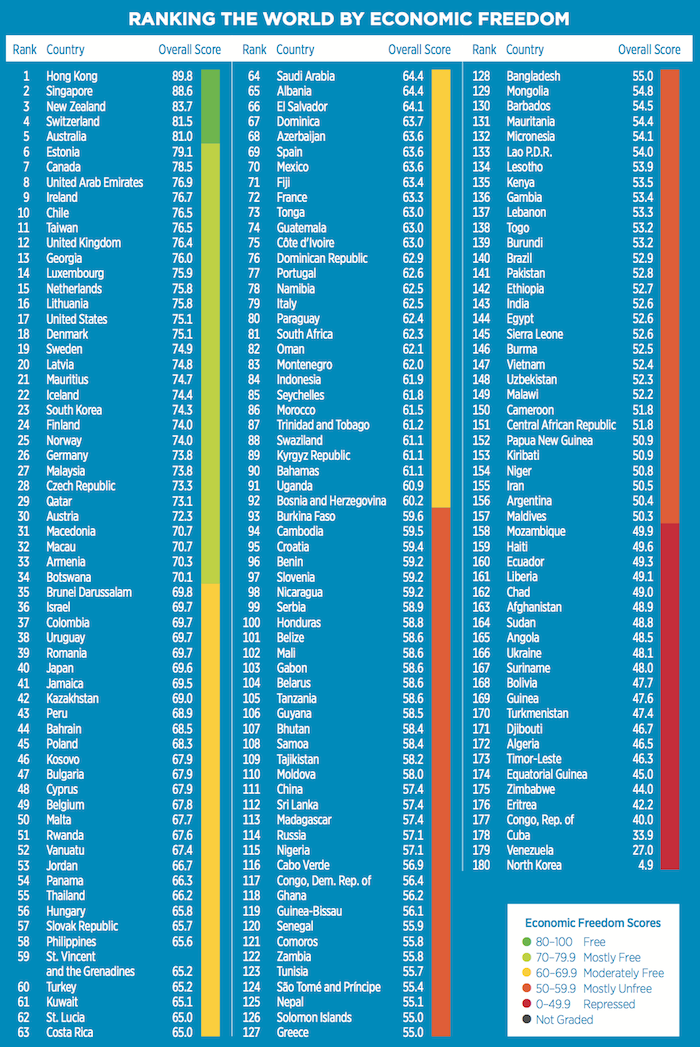

- Of the 180 economies whose economic freedom has been graded and ranked in the 2017 Index, only five (Hong Kong, Singapore, New Zealand, Switzerland, and Australia) have sustained very high freedom scores of 80 or more, putting them in the ranks of the economically “free.”

- A further 29 countries, including Chile, the United Arab Emirates, the United Kingdom, Georgia, the United States, and Mauritius, have been rated as “mostly free” economies with scores between 70 and 80.

- A total of 92 economies, just over half of those graded in the 2017 Index, have earned a designation of “moderately free” or better. These economies provide institutional environments in which individuals and private enterprises benefit from at least a moderate degree of economic freedom in the pursuit of greater competitiveness, growth, and prosperity.

- On the opposite side of the spectrum, nearly half of the countries graded in the Index—88 economies—have registered economic freedom scores below 60. Of those economies, 65 are considered “mostly unfree” (scores of 50–60), and 23 are considered “repressed” (scores below 50).

The Intangible Benefits of Economic Freedom

- Economic freedom is about much more than a business environment in which entrepreneurship and prosperity can flourish.

- With its far-reaching impacts on various aspects of human development, economic freedom empowers people, unleashes powerful forces of choice and opportunity, gives nourishment to other liberties, and improves the overall quality of life.

- It is true that in practice, each country’s path to growth and development must be tailored to its own conditions and even what is politically possible. However, there are some fundamentals to bear in mind. Nations with higher degrees of economic freedom prosper because they tend to capitalize more fully on the ability of the free-market system not only to generate economic growth, but also to reinforce dynamic growth through efficient resource allocation, value creation, and innovation.

What’s New in the 2017 Index?

The Index of Economic Freedom, The Heritage Foundation’s flagship product, has become an essential reference tool and policy guidebook for many leaders and scholars around the world over the past 23 years. During that time, a number of improvements have been made in data collection, evaluation, and display in an effort to enhance the substance and overall quality of the publication. Following that tradition, the 2017 edition of the Index incorporates a number of enhancements that are intended to ensure that it remains a practical resource that is both credible and relevant to a changing world while remaining true to its roots as an objective source of data-driven analysis and policy recommendations.

Specific enhancements this year include:

- New Country Page Design. Individual country pages of the Index are intended to provide both a quick visual snapshot of a country’s overall economic freedom and as much detailed information as space allows about developments and conditions in various aspects of that freedom. To improve the user-friendliness of the country pages, the 2017 Index incorporates a new page layout and full color charts that illustrate a country’s overall economic freedom score in a more intuitive and visually attractive way.

- Presentation of Country Pages by Region. The country pages in the 2017 Index are now grouped by region and presented in alphabetical order following a brief summary of regional developments. All countries of the Western Hemisphere are now grouped in a single Americas region.

- Enhanced Methodology. The number of components of economic freedom that are separately evaluated and graded has increased from 10 to 12. The increased reliability and availability of worldwide data from a variety of sources has permitted the incorporation of new components specifically addressing “Judicial Effectiveness” and “Fiscal Health.” The former Freedom from Corruption component has been refined, incorporating additional sub-factors and underlying data sources that are significantly more comprehensive than those formerly used, and renamed “Government Integrity.” Finally, the Fiscal Freedom component of the Index has been renamed “Tax Burden” to better reflect exactly what is being measured. Details of these methodological changes are provided in the Methodology Appendix.

- Equal Weighting. The four pillars of economic freedom—Rule of Law, Government Size, Regulatory Efficiency, and Open Markets—now carry equal weight in the computation of the overall economic freedom score. Each now includes three equally weighted components, presenting opportunities for new types of analytical comparisons reflecting the impact of reforms in broader policy areas.

To build a better world, we must have the courage to make a new start. We must clear away the obstacles with which human folly has recently encumbered our path and release the creative energy of individuals. We must create conditions favourable to progress rather than “planning progress.”… The guiding principle in any attempt to create a world of free men must be this: a policy of freedom for the individual is the only truly progressive policy.

—Friedrich A. Hayek

As a vital component of human dignity, autonomy, and personal empowerment, economic freedom is valuable as an end itself. Just as important, however, is the fact that economic freedom provides a formula for economic progress and success.

We know from the data we collect to build the Index that each measured aspect of economic freedom has a significant effect on economic growth and prosperity. Policies that allow greater freedom in any of the areas measured tend to spur growth. Growth, in turn, is an essential element in building lasting prosperity.

Economic freedom is not a single system, however. In many respects, it is the absence of a single dominating system. As previous editions of the Index have elaborated, economic freedom is not a dogmatic ideology. It represents instead a philosophy that rejects dogma and embraces diverse and even competing strategies for economic advancement. The Index also reveals that it is not the policies we fail to implement that hold back economic growth. Rather, it is the dreadful policies that, all too often, we put in place.

In other words, those who believe in economic freedom believe in the right of individuals to decide for themselves how to direct their lives. The added benefit from society’s point of view is the proven power of self-directed individuals, whether working alone or working together in associations or corporations, to create the goods and services that best respond to the needs and desires of their fellow citizens.

No country provides perfect freedom to its citizens, and those that do permit high levels of freedom differ with respect to which aspects they believe are most important. That is consistent with the nature of liberty, which allows individuals and societies to craft their own unique paths to prosperity.

Throughout the previous editions of the Index of Economic Freedom, we have explored many critical aspects of the relationships between individuals and governments. In measuring economic freedom, we have focused on a comprehensive yet far from exhaustive range of policy areas in which governments typically act, for good or ill. However, the concept of freedom by its very nature resists a narrow definition, and each year seems to bring new challenges from those who seek to impose their own views or control the economic actions of others.

As new threats to economic freedom arise around the world, our definitions and methodologies will continue to evolve so that we can provide as true a picture as possible of the state of economic freedom around the world.

DEFINING ECONOMIC FREEDOM

Economic freedom is at its heart about individual autonomy, concerned chiefly with the freedom of choice enjoyed by individuals in acquiring and using economic goods and resources. The underlying assumption of those who favor economic freedom is that individuals know their needs and desires best and that a self-directed life, guided by one’s own philosophies and priorities rather than those of a government or technocratic elite, is the foundation of a fulfilling existence. Independence and self-respect flow from the ability and responsibility to take care of oneself and one’s family and are invaluable contributors to human dignity and equality.

Living in societies as we do, individual autonomy can never be considered absolute. Many individuals regard the well-being of their families and communities as equal in importance to their own, and the personal rights enjoyed by one person may well end at his neighbor’s doorstep. Decisions and activities that have an impact or potential impact on others are rightly constrained by societal norms and, in the most critical areas, by government laws or regulations.

In a market-oriented economy, societal norms, not government laws and regulations, are the primary regulator of behavior. Such norms grow organically out of society itself, reflecting its history, its culture, and the experience of generations learning how to live with one another. They guide our understanding of ethics, the etiquette of personal and professional relationships, and consumer tastes. Democratic political systems, at their best, reflect societal norms in their laws and regulations, but even democratic governments, if unconstrained by constitutional or other traditional limits, may pose substantial threats to economic freedom. A constraint imposed on economic freedom by majority rule is no less a constraint than one imposed by an absolute ruler or oligarch. It is thus not so much the type of government that determines the degree of economic freedom as it is the extent to which government has limits beyond which it may not, or at least does not, go.

Inevitably, any discussion of economic freedom will focus on the critical relationship between individuals and the government. In general, state action or government control that interferes with individual autonomy limits economic freedom.

However, the goal of economic freedom is not simply the absence of government coercion or constraint, but rather the creation and maintenance of a mutual sense of liberty for all. Some government action is necessary for the citizens of a nation to defend themselves and promote the peaceful evolution of civil society, but when government action rises beyond the minimal necessary level, it is likely infringing on someone’s economic or personal freedom.

Throughout history, governments have imposed a wide array of constraints on economic activity. Such constraints, though sometimes imposed in the name of equality or some other ostensibly noble societal purpose, are in fact imposed most often for the benefit of societal elites or special interests. As Milton and Rose Friedman once observed:

A society that puts equality—in the sense of equality of outcome—ahead of freedom will end up with neither equality nor freedom. The use of force to achieve equality will destroy freedom, and the force, introduced for good purposes, will end up in the hands of people who use it to promote their own interests.

Government’s excessive intrusion into wide spheres of economic activity comes with a high cost to society as a whole. By substituting political judgments for those of the marketplace, government diverts entrepreneurial resources and energy from productive activities to rent-seeking, the quest for economically unearned benefits. The result is lower productivity, economic stagnation, and declining prosperity.

Assessing Economic Freedom

The Index of Economic Freedom takes a comprehensive view of economic freedom. Some of the aspects of economic freedom that are evaluated are concerned with a country’s interactions with the rest of the world (for example, the extent of an economy’s openness to global investment or trade). Most, however, focus on policies within a country, assessing the liberty of individuals to use their labor or finances without undue restraint and government interference.

Each of the measured aspects of economic freedom plays a vital role in promoting and sustaining personal and national prosperity. All are complementary in their impact, however, and progress in one area is often likely to reinforce or even inspire progress in another. Similarly, repressed economic freedom in one area (for example, a lack of respect for property rights) may make it much more difficult to achieve high levels of freedom in other categories.

The 12 aspects of economic freedom measured in the Index are grouped into four broad categories:

- Rule of law (property rights, judicial effectiveness, and government integrity);

- Government size (tax burden, government spending, and fiscal health);

- Regulatory efficiency (business freedom, labor freedom, and monetary freedom); and

- Market openness (trade freedom, investment freedom, and financial freedom).

Rule of Law

Property Rights. In a functioning market economy, the ability to accumulate private property and wealth is a central motivating force for workers and investors. The recognition of private property rights and an effective rule of law to protect them are vital features of a fully functioning market economy. Secure property rights give citizens the confidence to undertake entrepreneurial activity, save their income, and make long-term plans because they know that their income, savings, and property (both real and intellectual) are safe from unfair expropriation or theft.

Property rights are a primary factor in the accumulation of capital for production and investment. Secure titling is key to unlocking the wealth embodied in real estate, making natural resources available for economic use, and providing collateral for investment financing. It is also through the extension and protection of property rights that societies avoid the “tragedy of the commons,” the phenomenon that leads to the degradation and exploitation of property that is held communally and for which no one is accountable. A key aspect of property rights protection is the enforcement of contracts. The voluntary undertaking of contractual obligations is the foundation of the market system and the basis for economic specialization, gains from commercial exchange, and trade among nations. Evenhanded government enforcement of private contracts is essential to ensuring equity and integrity in the marketplace.

Judicial Effectiveness. Well-functioning legal frameworks protect the rights of all citizens against infringement of the law by others, including by governments and powerful parties. As an essential component of the rule of law, judicial effectiveness requires efficient and fair judicial systems to ensure that laws are fully respected, with appropriate legal actions taken against violations.

Judicial effectiveness, especially for developing countries, may be the area of economic freedom that is most important in laying the foundations for economic growth. In advanced economies, deviations from judicial effectiveness may be the first signs of serious problems that will lead to economic decline.

There is plenty of evidence from around the world that an honest, fair, and effective judicial system is a critical factor in empowering individuals, ending discrimination, and enhancing competition. In the never-ending struggle to improve the human condition and achieve greater prosperity, an institutional commitment to the preservation and advancement of judicial effectiveness is critical.

Government Integrity. In a world characterized by social and cultural diversity, practices regarded as corrupt in one place may simply reflect traditional interactions in another. For example, small informal payments to service providers or even government officials may be regarded variously as a normal means of compensation, a “tip” for unusually good service, or a corrupt form of extortion.

While such practices may indeed constrain an individual’s economic freedom, their impact on the economic system as a whole is likely to be modest. Of far greater concern is the systemic corruption of government institutions by such practices as bribery, nepotism, cronyism, patronage, embezzlement, and graft. Though not all are crimes in every society or circumstance, these practices erode the integrity of government wherever they are practiced. By allowing some individuals or special interests to gain government benefits at the expense of others, they are grossly incompatible with the principles of fair and equal treatment that are essential ingredients of an economically free society.

There is a direct relationship between the extent of government intervention in economic activity and the prevalence of corruption. In particular, excessive and redundant government regulations provide opportunities for bribery and graft. In addition, government regulations or restrictions in one area may create informal or black markets in another. For example, by imposing numerous burdensome barriers to conducting business, including regulatory red tape and high transaction costs, a government can incentivize bribery and encourage illegitimate and secret interactions that compromise the transparency that is essential for the efficient functioning of a free market.

Government Size

Tax Burden. All governments impose fiscal burdens on economic activity through taxation and borrowing. Governments that permit individuals and businesses to keep and manage a larger share of their income and wealth for their own benefit and use, however, maximize economic freedom.

The higher the government’s share of income or wealth, the lower the individual’s reward for his or her economic activity and the lower the incentive to undertake work at all. Higher tax rates reduce the ability of individuals and firms to pursue their goals in the marketplace and thereby lower the level of overall private-sector activity.

Individual and corporate income tax rates are an important and direct constraint on an individual’s economic freedom and are reflected as such in the Index, but they are not a comprehensive measure of the tax burden. Governments impose many other indirect taxes, including payroll, sales, and excise taxes, as well as tariffs and value-added taxes (VATs). In the Index of Economic Freedom, the burden of these taxes is captured by measuring the overall tax burden from all forms of taxation as a percentage of total gross domestic product (GDP).

Government Spending. The cost, size, and intrusiveness of government taken together are a central economic freedom issue that is measured in the Index in a variety of ways (see, for example, Tax Burden and Regulatory Efficiency). Government spending comes in many forms, not all of which are equally harmful to economic freedom. Some government spending (for example, to provide infrastructure, fund research, or improve human capital) may be considered investment. Government also spends on public goods, the benefits of which accrue broadly to society in ways that markets cannot price appropriately.

All government spending, however, must eventually be financed by higher taxation and entails an opportunity cost. This cost is the value of the consumption or investment that would have occurred had the resources involved been left in the private sector.

Excessive government spending runs a great risk of crowding out private economic activity. Even if an economy achieves faster growth through more government spending, such economic expansion tends to be only temporary, distorting the market allocation of resources and incentives for private investment. Even worse, a government’s insulation from market discipline often leads to bureaucracy, lower productivity, inefficiency, and mounting public debt that imposes an even greater burden on future generations.

Fiscal Health. A government’s budget is one of the clearest indicators of the extent to which it respects the principle of limited government. By delineating priorities and allocating resources, a budget signals clearly the areas in which government will intervene in economic activity and the extent of that intervention. Beyond that, however, a budget reflects a government’s commitment (or lack of commitment) to sound financial management of resources, which is both essential for dynamic long-term economic expansion and critical to the advancement of economic freedom.

Widening deficits and a growing debt burden, both of which are direct consequences of poor government budget management, lead to the erosion of a country’s overall fiscal health. Deviations from sound fiscal positions often disturb macroeconomic stability, induce economic uncertainty, and thus limit economic freedom.

Debt is an accumulation of budget deficits over time. In theory, debt financing of public spending could make a positive contribution to productive investment and ultimately to economic growth. Debt could also be a mechanism for positive macroeconomic countercyclical interventions or even long-term growth policies. On the other hand, high levels of public debt may have numerous negative impacts such as raising interest rates, crowding out private investment, and limiting government’s flexibility in responding to economic crises. Mounting public debt driven by persistent budget deficits, particularly spending that merely boosts government consumption or transfer payments, often undermines overall productivity growth and leads ultimately to economic stagnation rather than growth.

Regulatory Efficiency

Business Freedom. An individual’s ability to establish and run an enterprise without undue interference from the state is one of the most fundamental indicators of economic freedom. Burdensome and redundant regulations are the most common barriers to the free conduct of entrepreneurial activity. By increasing the costs of production, regulations can make it difficult for entrepreneurs to succeed in the marketplace.

Although many regulations hinder business productivity and profitability, the ones that most inhibit entrepreneurship are often those that are associated with licensing new businesses. In some countries, as well as many states in the United States, the procedure for obtaining a business license can be as simple as mailing in a registration form with a minimal fee. In Hong Kong, for example, obtaining a business license requires filling out a single form, and the process can be completed in a few hours. In other economies, such as India and parts of South America, the process of obtaining a business license can take much longer and involve endless trips to government offices and repeated encounters with officious and sometimes corrupt bureaucrats.

Once a business is open, government regulation may interfere with the normal decision-making or price-setting process. Interestingly, two countries with the same set of regulations can impose different regulatory burdens. If one country applies its regulations evenly and transparently, it can lower the regulatory burden by facilitating long-term business planning. If the other applies regulations inconsistently, it raises the regulatory burden by creating an unpredictable business environment.

Labor Freedom. The ability of individuals to find employment opportunities and work is a key component of economic freedom. By the same token, the ability of businesses to contract freely for labor and dismiss redundant workers when they are no longer needed is essential to enhancing productivity and sustaining overall economic growth.

The core principle of any economically free market is voluntary exchange. This is just as true in the labor market as it is in the market for goods.

State intervention generates the same problems in the labor market that it produces in any other market. Government labor regulations take a variety of forms, including minimum wages or other wage controls, limits on hours worked or other workplace conditions, restrictions on hiring and firing, and other constraints. In many countries, unions play an important role in regulating labor freedom and, depending on the nature of their activity, may be either a force for greater freedom or an impediment to the efficient functioning of labor markets.

Onerous labor laws penalize businesses and workers alike. Rigid labor regulations prevent employers and employees from freely negotiating changes in terms and conditions of work, and the result is often a chronic mismatch of labor supply and demand.

Monetary Freedom. Monetary freedom requires a stable currency and market-determined prices. Whether acting as entrepreneurs or as consumers, economically free people need a steady and reliable currency as a medium of exchange, unit of account, and store of value. Without monetary freedom, it is difficult to create long-term value or amass capital.

The value of a country’s currency can be influenced significantly by the monetary policy of its government. With a monetary policy that endeavors to fight inflation, maintain price stability, and preserve the nation’s wealth, people can rely on market prices for the foreseeable future. Investments, savings, and other longer-term plans can be made more confidently. An inflationary policy, by contrast, confiscates wealth like an invisible tax and distorts prices, misallocates resources, and raises the cost of doing business.

There is no single accepted theory of the right monetary policy for a free society. At one time, the gold standard enjoyed widespread support. What characterizes almost all monetary theories today, however, is support for low inflation and an independent central bank. There is also widespread recognition that price controls corrupt market efficiency and lead to shortages or surpluses.

Market Openness

Trade Freedom. Many governments place restrictions on their citizens’ ability to interact freely as buyers or sellers in the international marketplace. Trade restrictions can manifest themselves in the form of tariffs, export taxes, trade quotas, or outright trade bans. However, trade restrictions also appear in subtler ways, particularly in the form of regulatory barriers related to health or safety.

The degree to which government hinders the free flow of foreign commerce has a direct bearing on the ability of individuals to pursue their economic goals and maximize their productivity and well-being. Tariffs, for example, directly increase the prices that local consumers pay for foreign imports, but they also distort production incentives for local producers, causing them to produce either a good in which they lack a comparative advantage or more of a protected good than is economically ideal. This impedes overall economic efficiency and growth.

In many cases, trade limitations also put advanced-technology products and services beyond the reach of local entrepreneurs, limiting their own productive development.

Investment Freedom. A free and open investment environment provides maximum entrepreneurial opportunities and incentives for expanded economic activity, greater productivity, and job creation. The benefits of such an environment flow not only to the individual companies that take the entrepreneurial risk in expectation of greater return, but also to society as a whole. An effective investment framework is characterized by transparency and equity, supporting all types of firms rather than just large or strategically important companies, and encourages rather than discourages innovation and competition.

Restrictions on the movement of capital, both domestic and international, undermine the efficient allocation of resources and reduce productivity, distorting economic decision-making. Restrictions on cross-border investment can limit both inflows and outflows of capital, thereby shrinking markets and reducing opportunities for growth.

In an environment in which individuals and companies are free to choose where and how to invest, capital can flow to its best uses: to the sectors and activities where it is most needed and the returns are greatest. State action to redirect the flow of capital and limit choice is an imposition on the freedom of both the investor and the person seeking capital. The more restrictions a country imposes on investment, the lower its level of entrepreneurial activity.

Financial Freedom. An accessible and efficiently functioning formal financial system ensures the availability of diversified savings, credit, payment, and investment services to individuals and businesses. By expanding financing opportunities and promoting entrepreneurship, an open banking environment encourages competition in order to provide the most efficient financial intermediation between households and firms as well as between investors and entrepreneurs.

Through a process driven by supply and demand, markets provide real-time information on prices and immediate discipline for those who have made bad decisions. This process depends on transparency in the market and the integrity of the information being made available. A prudent and effective regulatory system, through disclosure requirements and independent auditing, ensures both.

Increasingly, the central role played by banks is being complemented by other financial services that offer alternative means for raising capital or diversifying risk. As with the banking system, the useful role for government in regulating these institutions lies in ensuring transparency and integrity and promoting disclosure of assets, liabilities, and risks.

Banking and financial regulation by the state that goes beyond the assurance of transparency and honesty in financial markets can impede efficiency, increase the costs of financing entrepreneurial activity, and limit competition. If the government intervenes in the stock market, for instance, it contravenes the choices of millions of individuals by interfering with the pricing of capital—the most critical function of a market economy.

ECONOMIC FREEDOM: MORE THAN A GOOD BUSINESS ENVIRONMENT

To be sure, economic freedom is about much more than a business environment in which entrepreneurship and prosperity can flourish. With its far-reaching impacts on various aspects of human development, economic freedom empowers people, unleashes powerful forces of choice and opportunity, nourishes other liberties, and improves the overall quality of life.

No alternative systems—and many have been tried—come close to the record of free-market capitalism in promoting growth and enhancing the human condition. The undeniable link between economic freedom and prosperity is a striking demonstration of what people can do when they are left to pursue their own interests within the rule of law.

To get ahead based on sheer merit and hard work, citizens of any country need a system that maintains nondiscriminatory markets, allocates resources impartially, and rewards individual effort and success. That is the recipe for economic freedom—and for the opportunity to build lasting prosperity and real human progress.

Societies Thrive as Economic Freedom Grows

For more than two decades, the Index of Economic Freedom has documented the vital role of economic freedom in promoting human progress. People living in nations with higher degrees of economic freedom prosper because their governments rely on systems of free markets to regulate economic activity. At their best, operating without interference, free markets identify and accommodate the needs of society based on the daily decisions of its individual members to buy or sell, to invest or save, reflecting their unique desires and knowledge: No bureaucracies or “experts” required. The collective wisdom that this fundamentally democratic process generates has been shown time and again to promote dynamic growth through efficient resource allocation, value creation, and innovation.

In a diverse world that, depending on where you look, may be either overregulated or underdeveloped or both, economic freedom may be experienced in a variety of settings, from an informal market lacking any form of governance to an advanced economy with carefully stipulated and enforced rules to protect integrity, promote competition, and limit the power within a market of any single participant, including the government itself. The Indexstrives to provide as comprehensive a view of economic freedom as possible with data that illuminate varying aspects of the rule of law, the size and scope of government, the efficiency of regulations, and the openness of the economy to global commerce.

The imperative to advance economic freedom is stronger than ever. Our world has experienced—is experiencing—astounding progress. Millions of the world’s people, however, still live in poverty, and millions in countries both rich and poor are clamoring for change.

Free-market capitalism, built on the principles of economic freedom, can provide that change. It pushes out the old to make way for the new so that real and true progress can take place. It leads to innovation in all realms: better jobs, better goods and services, and better societies.

The Global Economy: Only Moderately Free

Over the last year, the forces of economic freedom around the world have been resilient and even increasing. In fact, economic freedom has taken an upturn in the majority of the economies. Still, the world as a whole remains only moderately free. According to the 2018 Index:

Economic freedom improved worldwide for the sixth year in a row, with the average score up by two-tenths of a point from the previous year.

The global average economic freedom score of 61.1 is the highest ever recorded in the 24-year history of the Index. The world average is now more than three points higher than it was in the first edition of the Index in 1995.

Of the 180 economies graded in the 2018 Index, the scores of 102 are better, the scores of 75 are worse, and the scores of three are unchanged.

Six economies have sustained very high economic freedom scores of 80 or more, putting them in the ranks of the economically “free.”

The next 28 countries have been rated as “mostly free” economies, recording scores between 70 and 80. With scores of 60 to 70, 62 countries have earned scores that place them in the “moderately free” category. A total of 96 economies—53 percent of all nations and territories graded in the 2018 Index—provide institutional environments in which individuals and private enterprises benefit from at least a moderate degree of economic freedom in the pursuit of greater economic development and prosperity.

On the opposite side of the spectrum, nearly half of the countries graded in the Index—84 economies—have registered economic freedom scores below 60. Of those, 63 economies are considered “mostly unfree” (scores of 50–60), and 21 are clearly “repressed” (below 50).

The findings of the 2018 Index evince yet again the strongly positive linkages between economic freedom and various dimensions of human and socioeconomic development. The intricate, multidimensional, and nonlinear links highlight why economic freedom is unmatched both in finding solutions to human problems and in advancing overall well-being. No other alternatives that have been tried have come close to free-market capitalism based on economic freedom in terms of providing broader-based prosperity and making a greater number of innovative solutions available to the most people most effectively.

Economic Freedom: The Vital Link Between Opportunity and Prosperity

In general, the overarching objective of economic policies should be to create an environment that provides the best chance of translating opportunity into prosperity.

Today’s successful economies are not necessarily geographically large or richly blessed with natural resources. Many economies have managed to expand opportunities for their citizens by enhancing their economic dynamism. The Index results have shown that such economic dynamism can be sustained when governments adopt economic policies that empower individuals and firms with more choices, thereby encouraging greater entrepreneurship.

In other words, economic freedom is closely related to openness to entrepreneurial activity. Chart 1 shows the close correspondence between economic freedom and entrepreneurial opportunity measured by the Business Environment pillar of the Legatum Prosperity Index.

Given this relationship, it should be apparent that a government’s most effective stimulus activity will not be to increase its own spending or increase layers of regulation, both of which reduce economic freedom. The best results are likely to be achieved instead through policy reforms that improve the incentives that drive entrepreneurial activity, creating more opportunities for greater economic dynamism.

Equally notable is the strong positive relationship between economic freedom and levels of per capita income. For countries achieving scores that reflect even moderate levels of economic freedom (60 or above), the relationship between economic freedom and per capita GDP is highly significant.

As indicated in Chart 2, countries moving up the economic freedom scale show increasingly high levels of average income. Economies rated “free” or “mostly free” in the 2018 Index enjoy incomes that are over twice the average levels in all other countries and more than five times higher than the incomes of “repressed” economies.

Economic Freedom: Antidote to Poverty

By a great many measures, the past two decades, during which the Index has been charting the advance of economic freedom, have been the most prosperous in the history of humankind. Those countries that have adopted some version of free-market capitalism, with economies open to the free flow of goods, services, and capital, have participated in an era of globalization and economic integration that provided solutions to many of the world’s development problems.

Unquestionably, the free-market system that is rooted in the principles of economic freedom—empowerment of the individual, nondiscrimination, and open competition—has fueled unprecedented economic growth around the world. As Chart 3 illustrates, over the life of the Index, as the global economy has moved toward greater economic freedom, world GDP has nearly doubled. This progress has lifted hundreds of millions of people out of poverty and cut the global poverty rate by two-thirds.

By opening the gates of prosperity to ever more people around the world, economic freedom has made the world a profoundly better place. More people are living better lives than ever before. Clearly, this monumental reduction in global poverty is an achievement that should inspire celebration of the free-market system, deeper understanding of its dynamics, and greater commitment to its promotion.

The key driver of poverty reduction is dynamic and resilient economic growth that comes with improving economic freedom. Not surprisingly, one of the most important goals of economic policy in almost every country in the world has been to increase the rate of economic growth.

More specifically, as documented in the previous editions of the Index and supported by volumes of academic research, vibrant and lasting economic growth results when governments implement policies that enhance economic freedom and empower individuals with greater choice and more opportunities. In other words, advancing economic freedom is the imperative for dynamic economic expansion and true progress for a greater number of people.

As Chart 4 demonstrates, there is a robust relationship between improvements in economic freedom and levels of economic growth per capita. Whether long-term (20 years), medium-term (10 years), or short-term (five years), the relationship between positive changes in economic freedom and rates of economic growth is consistent. Improvements in economic freedom are a vital determinant of rates of economic expansion that will effectively reduce poverty.

Undeniably, countries moving toward greater economic freedom tend to achieve higher rates of growth in per capita GDP. In all of the three specific periods examined, the average annual per capita economic growth rates of countries that have grown economic freedom most are at least 50 percent higher than those of countries where freedom has stagnated or slowed.

Greater economic freedom, as one of the most effective means to eliminating poverty, has a major positive impact on poverty levels. Poverty intensity, as measured by the United Nations Development Programme’s Multidimensional Poverty Index, is much lower on average in countries with higher levels of economic freedom. As seen in Chart 5, the intensity of poverty in countries whose economies are considered mostly free or moderately free is only about one-third the level in countries that are rated less free.

Economic Freedom: Promoting Better Development and Democratic Progress

Growing economic freedom is unequivocally about achieving greater overall prosperity that goes beyond materialistic and monetary dimensions of well-being. The societal benefits of economic freedom extend far beyond higher incomes or reductions in poverty. Countries with higher levels of economic freedom enjoy higher levels of overall human development measured by the UNDP’s Human Development Index, which measures life expectancy, literacy, education, and the standard of living in countries worldwide. As Chart 6 shows, governments that choose policies that increase economic freedom are placing their societies on the pathway to more education opportunities, better health care, and greater standards of living for their citizens.

In recent years, policies and actions concerning the environment have tended to be intrusive and economically distortionary. Governments have pushed programs to tax carbon emissions and increase taxes on gasoline, set up nontransparent and economically harmful exchanges and marketplaces for the buying and selling of carbon emissions, and created subsidies for so-called clean energy. Such policies not only impose a huge cost on society, but also retard economic growth.

Fortunately, such trade-offs are not required. The same free-market principles that have proven to be the key to economic success can also deliver environmental success. Chart 7 shows the positive relationship between levels of economic freedom and levels of environmental protection as measured in the Yale University Environmental Performance Index.

In addition, in countries around the world, economic freedom has been shown to increase countries’ capacity for innovation and thus to improve overall environmental performance. The positive link between economic freedom and higher levels of innovation ensures greater economic dynamism in coping with various environmental challenges, and the most remarkable improvements in clean energy use and energy efficiency over the past decades have occurred not as a result of government regulation, but rather because of advances in economic freedom and freer trade. This has unleashed greater economic opportunity and generated a virtuous cycle of investment, innovation (including in greener technologies), and dynamic economic growth. (See Chart 8.)

Greater economic freedom also can provide more fertile ground for effective democratic governance. Debate over the direction of causality between economic freedom and democracy has become more controversial in recent years due to the multifaceted interaction between the two. Undoubtedly, achieving greater political freedom through well-functioning democracy is a messy and often excruciating process.

However, the positive relationship that exists between economic freedom and democratic governance is undeniable. (See Chart 9.) By empowering people to exercise greater control of their daily lives, economic freedom ultimately nurtures political reform by making it possible for individuals to gain the economic resources necessary to challenge entrenched interests or compete for political power, thereby encouraging the creation of more pluralistic societies.

Pursuit of greater economic freedom is thus an important stepping-stone to democracy. It empowers the poor and builds the middle class. It is a philosophy that encourages entrepreneurship and disperses economic power and decision-making throughout an economy.

Economic Freedom: Ensuring Upward Mobility and Greater Social Progress

The massive improvements in global indicators of income and quality of life largely reflect a paradigm shift in the debate about how societies should be structured to achieve the most optimal outcome. Over the past two decades, this debate has largely been won by capitalism. However, fears that the immediate benefits of capitalism are fading have brought to the forefront concerns about economic mobility and economic freedom. At the heart of ensuring upward economic mobility is the task of advancing economic freedom so that dynamic and inclusive growth can occur for everyone in a free society.

Economic freedom, cultivated by the rule of law, limited government, regulatory efficiency, and open markets, is critical to generating the broader-based economic growth that brings more opportunities for a greater number of people to work, produce, and save. In other words, ensuring greater economic freedom is directly related to preserving and enhancing dynamic upward mobility.

Also notable is that although some naysayers claim that economic and social progress has been limited in recent years as incomes in the developing world have become more unequal and individual economic freedom has expanded, the evidence does not support this contention. Instead, societies based on economic freedom are in fact the ones with the strongest social progress.

As shown in Chart 10, countries that provide an environment conducive to social progress also largely embrace economic freedom. Countries that improve their competitiveness and open their societies to new ideas, products, and innovations have largely achieved the high levels of social progress that their citizens demand. It is not massive redistributions of wealth or government dictates on income level that produce the most positive social outcomes. Instead, mobility and progress require lower barriers to entry, freedom to engage with the world, and less government intrusion.

Economic Freedom Matters

The 2018 Index of Economic Freedom shows that global economic freedom continues to advance, reaching the highest level in the 24-year history of the Index. Behind this record are stories of human progress and the achievements of countries and their citizens—literally billions of people around the world whose lives have measurably improved.

It is no coincidence that the explosion of economic liberty over the past decades has coincided with a massive worldwide reduction in poverty, disease, and hunger. The link between economic freedom and development is clear and strong: People in economically free societies live longer, have better health, are able to be better stewards of the environment, and push forward the frontiers of human achievement in science and technology through greater innovation.

A recurring theme throughout human history has been resilience and revival. The countries gaining ground in the 2018 Index of Economic Freedom demonstrate through their achievements that the proven strategies of the free-market system are up to the task of accelerating progress against even the most difficult challenges.

Endnotes

The Social Progress Index defines social progress as the capacity of a society to meet the basic human needs of its citizens, establish the building blocks that allow citizens and communities to enhance and sustain the quality of their lives, and create the conditions for all individuals to reach their full potential.

Regional Developments in Economic Freedom

Average levels of economic freedom vary widely among the five regions of the world. Europeans on average enjoy the highest levels of economic freedom with an average score of 68.8, far higher than the world average of 61.1. The Middle East/North Africa, Asia–Pacific, and Americas regions have average economic freedom scores near the world average at 61.5, 61.0, and 60.1, respectively, while the Sub-Saharan Africa region falls significantly short at only 54.4.

The benefits of economic freedom—greater income, wealth, better health, cleaner environments, and many more—are evident in every region, but there are substantial differences among the regions in terms of level of development and even economic culture that affect the relative importance of the various factors that go into an economic freedom score.

The 12 indicators that make up an economic freedom score are equally weighted in determining the rankings. For individual countries looking to improve their scores, however, a focus on the indicators in which they perform most poorly provides the greatest opportunity for major increases in economic freedom. A country that lags in fiscal health, for example, might want to prioritize reductions in fiscal deficits and debt. A country that lags in the rule of law could concentrate on addressing corruption, judicial effectiveness, and the protection of property rights. Such focus can bring significant immediate gains in economic freedom and corresponding improvements in economic growth and prosperity.

While there is diversity within every region, certain patterns have emerged that point to the relative importance of various factors in holding back or promoting economic freedom in each region. The countries of the Americas, for example, lag significantly in the rule of law and regulatory efficiency. Particularly for most of the Latin American countries in the region, a culture of corruption holds back foreign investment and job growth. And the typically poor quality of the regulatory environment stifles entrepreneurship. These, then, are the most important areas for reform in a typical country in the Americas.

In the Asia–Pacific region, it is market openness and particularly investment freedom and financial freedom that fall far below world standards on average. Action by populous countries like China and India to relax restrictions on foreign investment and open their banking systems to competition from around the world would improve the livelihoods of hundreds of millions of people. High-performing Asian economies like those of Hong Kong, Singapore, New Zealand, and Australia have shown the way.

It is in the area of government size that the European countries tend to lose points in their economic freedom scores. Burdensome levels of tax and extraordinarily high levels of government spending have led to unsustainable fiscal balances in many countries and have crowded out more productive private-sector activities.

The Middle East/North Africa region falls far behind others in fiscal health, with levels of government spending, particularly on consumer subsidies and income redistribution, far outpacing tax receipts in many countries. Problems related to the rule of law are notable throughout the region, as is a serious lack of investment freedom in many countries.

Sub-Saharan African countries trail world averages in almost every category of economic freedom. Particularly notable are the serious deficits in the property rights, judicial effectiveness, and government integrity scores, which are both cause and effect of the high levels of political instability and conflict throughout the region.

The following pages provide a summary snapshot of economic freedom in the various regions while highlighting significant developments in a few notable countries. A full description of the status of economic freedom in every country may be found in Chapter 4.

The 12 Economic Freedoms: A Global Look

Rule of Law

A number of governments made progress in enhancing judicial effectiveness by increasing institutional independence and accountability. Global scores for property rights and government integrity registered little, if any, change. The low average scores for these indicators reflect a poor overall level of protection for private property as well as the systemic corruption of government institutions by such practices as bribery, cronyism, and graft.

Government Size

The average top individual income tax rate for all countries in the world is about 28.5 percent, and the average top corporate tax rate is 24.1 percent. The average overall tax burden as a percentage of GDP corresponds to approximately 23.6 percent. The average level of government spending as a percentage of GDP is equal to 32.9 percent. The average level of gross public debt for countries covered in the Index is equivalent to about 55.6 percent of GDP.

Regulatory Efficiency

Many economies have continued to streamline and modernize their business frameworks, although the overall pace of reform in developed countries has generally lagged behind the pace in developing countries. For the world as a whole, a movement toward higher minimum wages continues with a risk of increasing poverty and dependence on government. Monetary freedom is stable, reflecting subdued inflationary pressures worldwide.

Open Markets

Global trade freedom is stuck in neutral with its score virtually unchanged from last year. Investment freedom advanced in the 2018 Index, but progress was uneven, and investment policy measures in many countries remain geared toward sectoral investment promotion rather than general market openness. Despite some progress in stability, financial institutions in many countries continue to face uncertain regulatory environments.

Methodology

The Index of Economic Freedom focuses on four key aspects of the economic environment over which governments typically exercise policy control:

- Rule of law,

- Government size,

- Regulatory efficiency, and

- Market openness.

In assessing conditions in these four categories, the Index measures 12 specific components of economic freedom, each of which is graded on a scale from 0 to 100. Scores on these 12 components of economic freedom, which are calculated from a number of sub-variables, are equally weighted and averaged to produce an overall economic freedom score for each economy.

The following sections provide detailed descriptions of the formulas and methodology used to compute the scores for each of the 12 components of economic freedom.

RULE OF LAW

Property Rights

The property rights component assesses the extent to which a country’s legal framework allows individuals to accumulate private property freely, secured by clear laws that the government enforces effectively. Relying on a mix of survey data and independent assessments, it provides a quantifiable measure of the degree to which a country’s laws protect private property rights and the extent to which those laws are respected. It also assesses the likelihood that private property will be expropriated by the state.

The more effective the legal protection of property, the higher a country’s score will be. Similarly, the greater the chances of government expropriation of property, the lower a country’s score will be.

The score for this component is derived by averaging scores for the following five sub-factors, all of which are weighted equally:

Physical property rights,

Intellectual property rights,

Strength of investor protection,

Risk of expropriation, and

Quality of land administration.

Each of these sub-factors is derived from numerical data sets that are normalized for comparative purposes using the following equation:

Sub-factor Score i = 100 x (Sub-factorMax–Sub-factori)/(Sub-factorMax–Sub-factorMin)

where Sub-factori represents the original data for country i; Sub-factorMax and Sub-factorMin represent the upper and lower bounds for the corresponding data set; and Sub-factor Score i represents the computed sub-factor score for country i.

For a few countries, comparable data were not available for every sub-factor. In those cases, a score was computed for the missing sub-factor based on the relative percentile ranking of that country on the other sub-factors.

Sources. The Index relies on the following sources for assessing property rights: World Economic Forum, World Competitiveness Report; World Bank, Doing Business; and Credendo Group, Country Risk Assessment.

Judicial Effectiveness

Well-functioning legal frameworks are essential for protecting the rights of all citizens against unlawful acts by others, including by governments and powerful private parties. Judicial effectiveness requires efficient and fair judicial systems to ensure that laws are fully respected, with appropriate legal actions taken against violations. The score for the judicial effectiveness component is derived by averaging scores for the following three sub-factors, all of which are weighted equally:

Judicial independence,

Quality of the judicial process, and

Likelihood of obtaining favorable judicial decisions.

Each of these sub-factors is derived from numerical data sets that are normalized for comparative purposes using the following equation:

Sub-factor Score i = 100 x (Sub-factorMax–Sub-factori)/(Sub-factorMax–Sub-factorMin)

where Sub-factori represents the original data for country i; Sub-factorMax and Sub-factorMin represent the upper and lower bounds for the corresponding data set; and Sub-factor Score i represents the computed sub-factor score for country i.

For a few countries, comparable data were not available for every sub-factor. In each of these cases, a score was computed for the missing sub-factor based on the country’s relative percentile ranking on the other sub-factors.

Sources. The Index relies on the following sources for assessing judicial effectiveness: World Economic Forum, World Competitiveness Report, and World Bank, Doing Business.

Government Integrity

Corruption erodes economic freedom by introducing insecurity and coercion into economic relations. Of greatest concern is the systemic corruption of government institutions and decision-making by such practices as bribery, extortion, nepotism, cronyism, patronage, embezzlement, and graft. The lack of government integrity caused by such practices reduces economic vitality by increasing costs and shifting resources into unproductive lobbying activities.

The score for this component is derived by averaging scores for the following six sub-factors, all of which are weighted equally:

Public trust in politicians,

Irregular payments and bribes,

Transparency of government policymaking,

Absence of corruption,

Perceptions of corruption, and

Governmental and civil service transparency.

Each of these sub-factors is derived from numerical data sets that are normalized for comparative purposes using the following equation:

Sub-factor Score i = 100 x (Sub-factorMax–Sub-factori)/(Sub-factorMax–Sub-factorMin)

where Sub-factori represents the original data for country i; Sub-factorMax and Sub-factorMin represent the upper and lower bounds for the corresponding data set; and Sub-factor Score i represents the computed sub-factor score for country i.

For a few countries, comparable data were not available for every sub-factor. In each of these cases, a score was computed for the missing sub-factor based on the country’s relative percentile ranking on the other sub-factors.

Sources. The Index relies on the following sources for assessing government integrity: World Economic Forum, World Competitiveness Report; World Justice Project, Rule of Law Index; Transparency International, Corruption Perceptions Index; and TRACE International, The Trace Matrix.

Government Size

Tax Burden

Tax burden is a composite measure that reflects marginal tax rates on both personal and corporate income and the overall level of taxation (including direct and indirect taxes imposed by all levels of government) as a percentage of gross domestic product (GDP). The component score is derived from three quantitative sub-factors:

The top marginal tax rate on individual income,

The top marginal tax rate on corporate income, and

The total tax burden as a percentage of GDP.

Each of these numerical variables is weighted equally as one-third of the component score. This equal weighting allows a country to achieve a score as high as 67 based on two of the factors even if it receives a score of 0 on the third.

Tax burden scores are calculated with a quadratic cost function to reflect the diminishing revenue returns from very high rates of taxation. The data for each sub-factor are converted to a 100-point scale using the following equation:

Tax Burdenij = 100 – α (Factorij)2

where Tax Burdenij represents the tax burden in country i for factor j; Factorij represents the value (a percentage expressed on a scale of 0 to 100) in country i for factor j; and α is a coefficient set equal to 0.03. The minimum score for each sub-factor is zero, which is not represented in the printed equation but was used because it means that no single high tax burden will make the other two sub-factors irrelevant.

As an example, in the 2018 Index, Mauritius has a flat rate of 15 percent for both individual and corporate tax rates, which yields a score of 93.3 for each of those two factors. Mauritius’s overall tax burden as a portion of GDP is 21.2 percent, yielding a score of 86.5 for that factor. When the three factors are averaged together, Mauritius’s overall tax burden score becomes 91.

Sources. The Index relies on the following sources for information on tax rate data, in order of priority: Deloitte, International Tax and Business Guide Highlights; International Monetary Fund, Staff Country Report, “Selected Issues and Statistical Appendix,” and Staff Country Report, “Article IV Consultation”; PricewaterhouseCoopers, Worldwide Tax Summaries; countries’ investment agencies; other government authorities (embassy confirmations and/or the country’s treasury or tax authority); and Economist Intelligence Unit, Country Commerce and Country Finance.

For information on tax burden as a percentage of GDP, the primary sources are Organisation for Economic Co-operation and Development data; Eurostat, Government Finance Statistics data; African Development Bank and Organisation for Economic Co-operation and Development, African Economic Outlook; International Monetary Fund, Staff Country Report, “Selected Issues,” and Staff Country Report, “Article IV Consultation”; Asian Development Bank, Key Indicators for Asia and the Pacific; United Nations Economic Commission for Latin America, Economic Survey of Latin America and the Caribbean; and individual contacts from government agencies and multinational organizations such as the IMF and the World Bank.

Government Spending

The government spending component captures the burden imposed by government expenditures, which includes consumption by the state and all transfer payments related to various entitlement programs.

No attempt has been made to identify an optimal level of government spending. The ideal level will vary from country to country, depending on factors that range from culture to geography to level of economic development. At some point, however, government spending becomes an unavoidable burden as growth in the size and scope of the public sector leads inevitably to misallocation of resources and loss of economic efficiency. Volumes of research have shown that excessive government spending that causes chronic budget deficits and the accumulation of public debt is one of the most serious drags on economic dynamism.

The Index methodology treats zero government spending as the benchmark. As a result, underdeveloped countries, particularly those with little government capacity, may receive artificially high scores. However, such governments, which can provide few if any public goods, are likely to receive low scores on some of the other components of economic freedom (such as property rights, financial freedom, and investment freedom) that measure aspects of government effectiveness.

Government spending has a major impact on economic freedom, but it is just one of many important components. The scale for scoring government spending is nonlinear, which means that government spending that is close to zero is lightly penalized, while levels of government spending that exceed 30 percent of GDP lead to much worse scores in a quadratic fashion (for example, doubling spending yields four times less freedom). Only extraordinarily large levels of government spending (for example, over 58 percent of GDP) receive a score of zero.

The equation used for computing a country’s government spending score is:

GEi = 100 – α (Expendituresi)2

where GEi represents the government expenditure score in country i; Expendituresi represents the average total government spending at all levels as a percentage of GDP for the most recent three years; and α is a coefficient to control for variation among scores (set at 0.03). The minimum component score is zero.

In most cases, the Index uses general government expenditure data that include all levels of government such as federal, state, and local. In cases where data on general government spending are not available, data on central government expenditures are used instead.

Sources. The Index relies on the following sources for information on government intervention in the economy, in order of priority: Organisation for Economic Co-operation and Development data; Eurostat data; African Development Bank and Organisation for Economic Co-operation and Development, African Economic Outlook; International Monetary Fund, Staff Country Report, “Selected Issues and Statistical Appendix,” Staff Country Report, “Article IV Consultation,” and World Economic Outlook Database; Asian Development Bank, Key Indicators for Asia and the Pacific; African Development Bank, The ADB Statistics Pocketbook; official government publications of each country; and United Nations Economic Commission for Latin America, Economic Survey of Latin America and the Caribbean.

Fiscal Health

Widening deficits and a growing debt burden, both of which are caused by poor government budget management, lead to the erosion of a country’s overall fiscal health. Deteriorating fiscal health, in turn, is associated with macroeconomic instability and economic uncertainty.

Debt is an accumulation of budget deficits over time. In theory, debt financing of public spending could make a positive contribution to productive investment and ultimately to economic growth. However, mounting public debt driven by persistent budget deficits, particularly spending that merely boosts government consumption or transfer payments, often undermines overall productivity growth and leads ultimately to economic stagnation rather than growth.

The score for the fiscal health component is based on two sub-factors, which are weighted as follows in calculating the overall component score:

Average deficits as a percentage of GDP for the most recent three years (80 percent of score) and

Debt as a percentage of GDP (20 percent of score).

The equation used for computing a country’s fiscal health score is:

Sub-factor Scorei = 100 – α (Sub-factori)2

where Sub-factor Scorei represents the deficit or debt score in country i; Sub-factori represents the factor value as a portion of GDP; and α is a coefficient to control for variation among scores (set at 2 for deficit and 0.01 for debt). The minimum sub-factor score is zero.

In most cases, the Index uses general government deficit and debt data that include all levels of government such as federal, state, and local. In cases where such general government data are not available, data on central government expenditures are used instead.

Sources. The Index relies on the following sources for information on government intervention in the economy, in order of priority: International Monetary Fund, World Economic Outlook Database, Staff Country Report, “Selected Issues and Statistical Appendix,” and Staff Country Report, “Article IV Consultation”; Asian Development Bank, Key Indicators for Asia and the Pacific; African Development Bank, The ADB Statistics Pocketbook; Economist Intelligence Unit, Data Tool; and official government publications of each country.

REGULATORY EFFICIENCY

Business Freedom

The business freedom component measures the extent to which the regulatory and infrastructure environments constrain the efficient operation of businesses. The quantitative score is derived from an array of factors that affect the ease of starting, operating, and closing a business.

The business freedom score for each country is a number between 0 and 100, with 100 indicating the freest business environment. The score is based on 13 sub-factors, all of which are weighted equally, using data from the World Bank’s Doing Business report:

Starting a business—procedures (number);

Starting a business—time (days);

Starting a business—cost (% of income per capita);

Starting a business—minimum capital (% of income per capita);

Obtaining a license—procedures (number);

Obtaining a license—time (days);

Obtaining a license—cost (% of income per capita);

Closing a business—time (years);

Closing a business—cost (% of estate);

Closing a business—recovery rate (cents on the dollar);

Getting electricity—procedures (number);

Getting electricity—time (days); and

Getting electricity—cost (% of income per capita).

Each of these sub-factors is converted to a scale of 0 to 100, after which the average of the converted values is computed. The result represents the country’s business freedom score in comparison to the business freedom scores of other countries.

Each sub-factor is converted to a scale of 0 to 100 using the following equation:

Sub-factor Scorei = 50 x (Sub-factoraverage/Sub-factori )

which is based on the ratio of the country data for each sub-factor relative to the world average, multiplied by 50. For example, on average worldwide, it takes 21 days to start a business. Israel’s 12 days to start a business is a sub-factor value that is better than the average, resulting in a ratio of 1.75. That ratio multiplied by 50 equals the final sub-factor score of 87.5.

For the five countries that are not covered by the World Bank’s Doing Business report, business freedom is scored by analyzing business regulations based on qualitative information from reliable and internationally recognized sources.

Sources. The Index relies on the following sources in determining business freedom scores, in order of priority: World Bank, Doing Business; Economist Intelligence Unit, Country Commerce; U.S. Department of Commerce, Country Commercial Guide; and official government publications of each country.

Labor Freedom

The labor freedom component is a quantitative measure that considers various aspects of the legal and regulatory framework of a country’s labor market, including regulations concerning minimum wages, laws inhibiting layoffs, severance requirements, and measurable regulatory restraints on hiring and hours worked, plus the labor force participation rate as an indicative measure of employment opportunities in the labor market.

Seven quantitative sub-factors are equally weighted, with each counted as one-seventh of the labor freedom component:

Ratio of minimum wage to the average value added per worker,

Hindrance to hiring additional workers,

Rigidity of hours,

Difficulty of firing redundant employees,

Legally mandated notice period,

Mandatory severance pay, and

Labor force participation rate.

In constructing the labor freedom score, each of the seven sub-factors is converted to a scale of 0 to 100 based on the following equation:

Sub-factor Scorei = 50 x (Sub-factoraverage/Sub-factori)

where country i data are calculated relative to the world average and then multiplied by 50. The seven sub-factor scores are then averaged for each country, yielding a labor freedom score in comparison to other countries.

The simple average of the converted values for the seven sub-factors is computed to obtain the country’s overall labor freedom score.

For the five countries that are not covered by the World Bank’s Doing Business report, the labor freedom component is scored by looking at labor market flexibility based on qualitative information from other reliable and internationally recognized sources.

Sources. The Index relies on the following sources for data on labor freedom, in order of priority: World Bank, Doing Business; International Labour Organization, Statistics and Databases; World Bank, World Development Indicators; Economist Intelligence Unit, Country Commerce; U.S. Department of Commerce, Country Commercial Guide; and official government publications of each country.

Monetary Freedom

Monetary freedom combines a measure of price stability with an assessment of price controls. Both inflation and price controls distort market activity. Price stability without microeconomic intervention is the ideal state for the free market.

The score for the monetary freedom component is based on two sub-factors:

The weighted average inflation rate for the most recent three years and

Price controls.

The weighted average inflation rate for the most recent three years serves as the primary input into an equation that generates the base score for monetary freedom. The extent of price controls is then assessed as a penalty deduction of up to 20 points from the base score. The two equations used to convert inflation rates into the final monetary freedom score are:

Weighted Avg. Inflationi = θ1 Inflationit + θ2Inflationit–1 + θ3 Inflationit–2

Monetary Freedomi = 100 – α √Weighted Avg. Inflationi – PC penaltyi

where θ1 through θ3 (thetas 1–3) represent three numbers that sum to 1 and are exponentially smaller in sequence (in this case, values of 0.665, 0.245, and 0.090, respectively); Inflationit is the absolute value of the annual inflation rate in country i during year t as measured by the Consumer Price Index; α represents a coefficient that stabilizes the variance of scores; and the price control (PC) penalty is an assigned value of 0–20 penalty points based on the extent of price controls.

The convex (square root) functional form was chosen to create separation among countries with low inflation rates. A concave functional form would essentially treat all hyperinflations as equally bad, whether they were 100 percent price increases annually or 100,000 percent, whereas the square root provides much more gradation. The α coefficient is set to equal 6.333, which converts a 10 percent inflation rate into a freedom score of 80.0 and a 2 percent inflation rate into a score of 91.0.

Sources. The Index relies on the following sources for data on monetary policy, in order of priority: International Monetary Fund, International Financial Statistics Online; International Monetary Fund, World Economic Outlook and Staff Country Report, “Article IV Consultation”; Economist Intelligence Unit, ViewsWire and Data Tool; various World Bank country reports; various news and magazine articles; and official government publications of each country.

OPEN MARKETS

Trade Freedom

Trade freedom is a composite measure of the extent of tariff and nontariff barriers that affect imports and exports of goods and services. The trade freedom score is based on two inputs:

The trade-weighted average tariff rate and