Introduction: How the money and the business flows…

Managing your own department is only part of the responsibilities in the world of management. Most companies have multiple departments to run the business. No matter what department you run, you should know how to interact and understand the functions of each department within a business organization. These next three lessons cover the fundamental basics of what is taught in an MBA course, including the parts of an organization that make up a business. If anyone of these particular departments are ones in which you currently work in, or would like to be a part of, you should find individualized training, which will go into more in depth detail regarding the subject matter. For continuity, we will use the point of view of how a “Customer Service Manager” might interact with the departments described in these next three lessons.

Managers spend time with other departments working on inter-department workflow processes, in daily or weekly management meetings, on conference calls, or meetings with the CEO. Your co-managers from different departments will be your allies and you want to keep them close. You should always have a cooperative relationship with your fellow management staff. This is why you need to understand, at least at a basic level, the functionalities of their departments. You want to be able to understand the basics of what they are talking about, especially when they are going over their performance goals. You also want to be able to understand what the CEO is talking about, much of which is usually financially based, and how you will be able to share the company’s vision with your department.

You will be in a much stronger position if you understand the dynamics of finance and overall business theory. It’s not merely for the sake of understanding another discipline, but in order to make sounder decisions likely to produce a greater return for your department. You can stand behind the logic, and not worry about the skills to challenge the assumption. By understanding the basic financial terms, economics, legal, ethics, sales figures, marketing strategies, customer service and operating functions, you will feel confident, and not blinded by science, when you are in management meetings. It will give you a chance to contribute more, and not be self-conscious about your lack of knowledge.

In this lesson we will be reviewing the different types of business along with an overview of ethics, economics, finance, accounting, budgets, and legal.

Business Types

A business in its most basic form sells a product such as shoes, cars, and burgers, or delivers a service such as telephone, cable TV, and auto repair. The goal is to make a profit. Businesses use some combination of labor, equipment, and materials to produce products or services.

Here are the most common forms to set up a business organization, with a brief explanation of each:

Sole Proprietorship – A business owned by one person who is self-employed and has the rights to profits and is responsible for debts. The upside is full control, can sell whenever desired, and fewer regulations. The main downside is the owner is personally liable for all business debts, and it is harder to raise capital from investors. Most small businesses are organized as a sole proprietorship and will usually incorporate when the business grows in size.

Partnership – A business owned by two or more individuals who contribute funds and shares the profits and debts. Common Partnerships are accounting, law, consulting, and architectural firms.

Corporation – A business in which legally the owners are not personally liable for the financial obligations of the business. They can only lose the money they invest in the corporation. The investment is when they contribute money, or if applicable, when they buy stock in the company. A share of stock represents a share in the ownership. If the company is a publicly held corporation, the general public can also own stocks. Owners are not personally liable and a corporation is often referred to as a “legal person.” It can use the terms “Inc.” “Incorporated,” or “Company.”

Limited Liability Company (LLC) - A business authorized by state law. Although exact characteristics vary by state, the most common characteristics of the limited liability company are that it has:

1. Limited liability, that is, the owners of the company are not liable for more than the capital they have invested in the business.

2. Managed by members or managers, owners can be members or managers.

3. Limitations on the transfer of ownership.

LLC's are becoming an increasingly popular way to start a business because LLC's are generally a less complicated business structure than a corporation, and provide a significant amount of protection.

Business Ethics and Law

Using the same moral guidelines you already follow yourself, knowing the difference between right and wrong, also goes for business. It will tell you what is right or wrong in any business situation. Sometimes, however, what might be best for the company might seem morally wrong personally. For example, buying cheaper goods from another country will help increase the company’s profit margin, however, that country legally allows children to work for low wages. At the end of the day, businesses should be as ethically sound as they can when determining the “greater good” for all involved.

Companies that violate the more obvious ethical practices can result in huge consequences. Just look at what happened to Enron. Problems usually start off small, but build into bigger ones unless standards are truly set and followed. With the pressure to achieve the numbers, bad decisions can be made. This can be pressure on the customer service representative to wrongly fill an order, to senior management falsifying the financial health of the company.

Some business ethics, however, are much more easily recognizable as being obviously ethically wrong. To name a few:

- Money lost to Fraud

- Money lost to Embezzlement

- Accuracy of books, records, and expense reports

- Proper use of organizational assets

- Protecting proprietary information

- Discrimination

- Lying

- Over charging

- Charging for work that was not necessary

- Withholding needed information

- Abusive or intimidating behavior toward others

- Misreporting actual time or hours worked

- False insurance claims

- Kickbacks and bribery

- Proper exercise of authority

- Theft of business equipment and supplies

- Trading or accepting goods for unauthorized favors

- Moonlighting, which causes poorer work performance

- Knowingly ignoring the health and safety of employees

- Sexual harassment

- Evading someone’s privacy

Using basic common sense, if you as manager always act with integrity, you will not violate business laws or be associated with bad work ethics. This not only prevents any problems for you personally and professionally, you will also be seen and known as a solid and trustworthy leader. Make it known that everyone is expected to adhere to the highest standards of business ethics and must understand that anything less is totally unacceptable.

Standards regarding ethical behavior need to be developed, set, and communicated throughout the entire company. For more information on ethical issues, go to www.ethics.org.

The legal department of a company takes charge of all legal matters of the company including labor laws, contracts, and legal representation. They are the team who will get involved with any legal troubles. You would have to take a course in business law to understand all of the ramifications associated with the legal department, however, we will give a brief explanation of some of the most known business laws faced by the legal department.

Basically, business law governs the rules of conduct of people and organizations in business, and is meant to enforce justice and obligation. The major areas of business law are:

Antitrust – which its laws ensure that competition remains fair by prohibiting companies from merging with one another, or acquiring one another, to form monopolies. A monopoly exists when there is only one supplier of some product or service, and can then charge whatever price it wants due to there is no longer any competition.

Bankruptcy – which laws let a company that is having financial problems seek protection from the demands of creditors. Chapter 11 of the bankruptcy code regulates liquidation, which means closing the company and selling its assets to creditors, and chapter 7 regulates reorganizations, which means a court supervised restructuring of a company while its creditors wait for payment.

Business organization – which are the laws that govern the formation of a business.

Consumer protection and product liability – which are regulations regarding products, services, and credit practices. Consumers should be able to assume that products will work and food is safe to eat, which is FDA regulated. Also a company cannot knowingly sell a product that it believes will be unsafe or harmful for its intended use.

Contracts – which are legally binding exchanges of promises or agreement between parties that the law will enforce.

Employment – which are laws that regulate the hours and conditions under which people work, such as child labor laws, sets minimum wage, and expands the rights of disabled people. You need to take all discriminatory laws associated with employment very seriously. The Equal Employment Opportunity Commission or the EEOC enforces these laws. The website is www.eeoc.gov.

Intellectual property – which laws protect copyrights, trademarks, and patents.

Securities regulation – which is governed by the Securities and Exchange Commission (SEC). It polices the financial markets regarding insider trading, stock price manipulation, improper financial reporting, and improper and illegal practices at brokerage firms.

As manager, if you encounter any type of legal issue that you are not 100% aware of, or not comfortable with, be sure to ask your boss or the legal department for help. This includes the signing of any legal documentation. Always be careful on what you say and how you act. If you do get into some trouble, contact an attorney right away. However, common sense should always prevail, and you will be all right as long as you are ethically sound whenever any possible legal issues, such as discrimination or consumer protection, occur.

Basic Economics overview

Although there are many interpretations, economics is basically “the study of what constitutes rational human behavior in the endeavor to fulfill needs and wants.”

In business, companies follow economic news to make decisions on what products to make or discontinue, when to hire or lay off employees, build or sell a factory, spend more or less on advertising, etc. Economics is a vastly huge subject and can go into a world of theories and complicated mathematical formulas. We will, however, cover some of the basics.

The foundation of economics is Scarcity, which refers to the tension between our limited resources and our unlimited wants and needs. Scarcity is the basic economic problem that arises because people have unlimited wants, but resources are limited. Because of scarcity, various economic decisions must be made to allocate resources efficiently. These decisions are made by giving up, or trading off, one want to satisfy another. For an individual, resources include time, money and skill. For a country, limited resources include national resources, capital, labor force, and technology. The most common phrase that you have probably heard regarding economics is, “Supply and Demand.”

Supply is the quantity of a product produced and offered for sale. The more buyers are willing to pay, the more incentive to increase the supply. On the other hand, the less that buyers are willing to pay, the more incentive to lower the price to decrease the surplus. For example, if the quantity supplied of the product is 30, and the quantity demanded for the product is 20, there would be a surplus of 10 products (30-20=10). The sellers would have to lower the price in order to sell excess supply.

Demand is based on price. The law of demand is basically; the higher the price, the lower the quantity demanded, and the lower the price, the higher the quantity demanded. As the price for a product rises, demand for that product will fall. On the other hand, if the sellers lowered the price for the product too much, demand would increase beyond what is supplied, and there would be a shortage. The optimal is to have equilibrium where the price point for the quantity supplied is in balance with the quantity demanded.

When the price is just right with no surplus and no shortage, supply and demand is known to be in Equilibrium. This means that the quantity demanded equals the quantity supplied. This is what economists use to look at regarding supply and demand for a product. A product is in equilibrium when the market price is set just right. If the market price drops, demand will exceed supply, thus prices will rise. If the market price increases, supply will exceed demand and prices will drop.

Basic Supply and Demand graph – The cross point is where supply and demand are in balance, or equilibrium, based on price and quantity:

Two branches of economics are Microeconomics and Macroeconomics. Microeconomics is the study of the decisions of individuals, households, and businesses in specific markets, whereas macroeconomics is the study of the overall functioning of an economy such as basic economic growth, unemployment, recession, depression, or inflation.

Microeconomics focuses on supply and demand and other forces that determine the price levels seen in the economy. It analyzes the market behavior of individual consumers and firms in an attempt to understand the decision-making process of firms and households. It studies the shifts in demand based on income and other consumer factors. An increase in income normally leads to an increase in the amount people are willing to pay for goods, thus are more prone to buy more luxury items. There are also competing substitute products or services, which can lower the price of the original.

Macroeconomics focuses on the national economy as a whole and provides a basic knowledge of how things work in the business world, for example, the impacts of money supply, interest rates, unemployment, and government deficits.

The way we usually measure the size of an economy is by its Gross Domestic Product or GDP. GDP is the value of all the goods and services produced within our borders in one year. People who study macroeconomics would be able to interpret GDP figures and how they relate to our national economy. Basically, GDP measures the size of the national economy by the total value of all goods and services produced within a nations border. This is a key economic indicator for economic growth rate, which measures how much bigger or smaller an economy is one period, compared with the same period a year ago. The formula used, and a brief explanations of the components measured in GDP, is:

· GDP = C + I + G + (Ex – IM). C is for Consumption (household spending), I is for Investments (business spending), G is for government (federal, state and local spending). "Ex" is for Export (goods shipped out of the country that made them) and "Im" is for Import (goods shipped into the country that outside countries made). You can see that if any component increases, the total GDP increases. If any component decreases, the total GDP decreases. There is a never-ending business cycle, which is a long-run pattern of economic growth and recession, also known as boom and bust, because of fluctuations in demand. Recovery always follows recession, and vice-versa. A business cycle is like the domino effect: During a recovery, consumers buy more (C or Consumption), which then means businesses invest more in equipment and staff (I or investments), etc. During a recovery, the business cycle is on an upswing and GDP growth continues. During a recession, the exact opposite is true. This is important to know because as manager, you do not want to get stuck with excess inventory or hire un-needed additional staff because you didn’t see the economic slowdown coming, or vice-versa because you do not have the goods to sell due to an increase in demand.

The Federal Reserve, also known as “the Fed,” controls the U.S. money supply. It is the central banking system of the United States. It replaces old currency with new currency, guarantees bank deposits, and governs the banking system. The Fed affects the economy by moving interest rates, selling and buying government securities, and talking about the economy (known as “moral suasion”). The Fed manages two kinds of economic policy:

· Fiscal policy, which is the spending and taxation to stimulate or “cool” the economy by adjusting taxes and spending. It can raise or lower spending and raise or lower taxes. Using an increase in government spending to ignite a recovery is called fiscal stimulus. If the government spends more than it collects in taxes, it is deficit spending. The government can lower taxes as well to ignite a recovery instead of increasing spending. The government can do the exact opposite if it sees inflation heading upward to cool off the economy by raising taxes or reduce spending.

· Monetary policy, which uses interest rates, purchases, and sales of government securities to heat or cool the economy. The Fed sets the rate for short-term loans that banks make to one another, called the Fed funds rate, and the rate that the Fed makes with loans to banks, called the Discount rate. These tend to drive other interest rates. If interest rates are decreased, that makes for easier credit to start spending and increase demand, which also makes it easier to repay the loan. If it starts to overheat heading towards inflation, then the opposite is true to cool down the economy. The Fed can also sell government securities, which are bonds or government debt, to cool an economy. The government has the consumers and businesses money, which means there is less in circulation, thus less spending and less economic growth, which would result in reducing inflation. If the Feds want to heat up the economy, they buy back the securities, then cash will be back in the consumer and businesses hands to spend, etc.

At the end of the day, the government wants a sound currency, low unemployment, and sustained economic growth.

Here are some more economic terms, and key economic indicators or trends, which are commonly used:

o Bubble - When the price of an asset rises far higher than can be explained by fundamentals.

o Business cycle - The business cycle has four stages including expansion, peak, recession, and recovery. Lastly, recovery is what happens after security prices fall and eventually go back up.

o Capitalism – Economic system based on private ownership, production, and distribution of goods. It is based on “Free Enterprise,” which means the government should not interfere with the economy. It’s about competition for profit.

o Consumer Confidence – A psychological view from consumers on how they feel about the economy and their prospects in the current and future economy.

o Depreciation - A fall in the value of an asset or a currency; the opposite of appreciation.

o Depression – A bad, depressingly prolonged recession in economic activity. The textbook definition of a recession is two consecutive quarters of declining output. A slump is where output falls by at least 10%; a depression is an even deeper and more prolonged slump.

o Housing Starts – The start of construction on new homes is an economic indicator. This is due to declining housing also means declining purchases that goes with a new home such as carpeting, appliances, drapes, electronic equipment, and labor such as painting and landscapers. There is a domino effect when housing sales are slow for both new homes and existing homes.

o Inflation - Rising prices, across the board. Inflation basically means your dollar does not go as far as it used to as it erodes the purchasing power of a unit of currency. It is usually expressed as an annual percentage rate of change. If prices raise gradually, consumers can adjust. However, rapid inflation can destabilize the economy. Prices and inflation are key economic indicators.

o Pareto principle (also known as the 80-20 rule) – This states that eighty percent of result is obtained due to 20 percent of actions. For example, 20% of the people own 80% of the wealth, or 20% of the sales force contributes to 80% of all revenue, etc. This rule can be used in just about any situation. For example, 80% of your better employees will only take 20% of your time to coach, thus the other 20% of your employees will take 80% of your time.

o Prime Rate – This is the rate on loans that a bank charges its most creditworthy corporate customers. This is set by several major New York banks. A sub-prime rate is for such companies or individuals that don't meet criteria of best market rates and have a history of deficient credit. Interest rates are a key economic indicator.

o Recession - A period of decline in a national economy over a period of time, usually two quarters of a financial year. Spending and demand decrease, making the economic climate more difficult.

o Securities - Financial contracts, such as:

Bonds, which is basically an IOU that states that if an investor lends money to the government or a corporation now, then they will pay your money back at a stated time in the future while making small interest payments to you along the way.

Shares, which is part ownership of a company.

Derivatives, which are financial assets that “derive” their value from other assets that grant the owner a stake in an asset. Such securities account for most of what is traded in the financial markets.

o Stock market – Basically, a high or raising stock market indicates a recovery is in progress and a failing market indicates recession. The Dow Jones Industrial Average (DJIA) is based upon 30 extremely large blue chip U.S. corporations, such as GE, Microsoft, and Coca Cola, and is used as a key economic indicator.

o Unemployment rate - The number of people of working age without a job is usually expressed as the unemployment rate, which is a percentage of the workforce. This is one of the key economic indicators. This rate generally rises and falls in step with the business cycle. The average goal is no lower than 4% and no higher than 8%. If it goes too much lower, then inflation usually occurs. If it goes too much higher, then the country could be headed towards a recession.

o Venture Capital (VC) – Private equity to help new companies grow. A valuable alternative source of finance for entrepreneurs, who might otherwise have to rely on a loan from a risk averse bank manager.

o Yield – The return on an investment expressed as a percentage of the cost of the investment.

Corporate Finance Overview

Corporate finance is the specific area of finance dealing with the financial decisions corporations make, and the tools and analysis used to make the decisions. Finance makes sure the company has the money it needs in order to operate. They are able to show external and internal parties financial data through financial statements, prepared by accountants, which are used to make decisions about the firm’s financial condition, and to advise others about possible losses and profits. Finance analyzes the health and growth of a company, manages the company’s cash, and deals with banks. Most mid to large size companies will have a CFO (Chief Financial Officer) who oversees the finance department, which normally consists of a controller, managerial accountant and/or general ledger accountant.

Finance is also involved with leasing property, equipment, purchasing raw materials, and pays employees. They provide helpful information in monitoring and evaluating management performance such as helping departments prepare their budgets and consolidate it into one company budget. They work with the Senior Management team (the CFO is part of this team) to set the company’s sales and profit goals for the year. Senior Managers use accounting information in making investment decisions, investors use accounting information to value stock, and bankers rely on accounting information in determining any potential risks to lend money.

Besides what has been previously stated, some more detailed responsibilities of corporate finance are:

- Cash flow budgeting and working capital management, which is managing the relationship between a firm's short-term assets and its short-term liabilities. The goal of working capital management is to ensure that the firm is able to continue its operations, and that it has sufficient cash flow to satisfy both maturing short-term debt and upcoming operational expenses. Working capital is: “current assets minus current liabilities.” Working capital measures how much in liquid assets a company has available to build its business.

- Comparing alternative proposals.

- Forecasting and risk analysis.

- Raise and manage its capital: Obtaining funds, debt or equity sources, long-term or short-term, and optimum capital structure.

- Allocations of funds to long-term capital investments vs. optimize short-term cash flow.

- Dividend policy.

- The risk-return framework and the identification of the asset appropriate discount rate.

- Valuation of assets. Discounting of relevant cash flows, relative valuation, and contingent claim valuation.

- The optimum allocation of funds. What to invest in? How much to invest? When to invest?

- How much money will be needed at various points in the future? How will it be funded?

- Identification of required expenditure of a public sector entity.

- Source of that entity's revenue.

We will not be able to go over each of the items just described, as you would need to take a full time financial course to fully understand it all. However, we will go over and discuss the items you might encounter whenever dealing with finance or upper management. We will present an overview of financial accounting and managerial accounting. We will discuss and have examples of two financial statements, the balance sheet and income statement. We will also discuss the cash flow statement. We’ll cover terms like Assets, Liabilities, Equity, COGS, SG&A, EBIT, EBITDA, Margins, ROI, FIFO, LIFO and Capex. And, we will demonstrate some of the most common financial analysis ratios, present a basic overview of inventory accounting, go over basic accountant responsibilities, and finally ending up with how to set up a budget.

As a manager, you should understand the basic financial statements and the associated terms in order to know how your budgets, transactions, and decisions affect the company.

Financial Accounting and Managerial Accounting

Accounting provides the reliable and relevant financial information useful in making decisions. Monetary events are first identified such as the type of sales and expenses, then recorded by documenting and entering the data, and finally presented to external parties who are outside of the company, usually through financial statements, and internal parties who are the people inside the company, usually through various reports.

Financial Accounting provides information for external parties who are interested in the company’s accounting information. Examples would be reports to investors and stockholders, creditors, taxing authorities or even customers, usually through financial statements. The two most common statements are the balance sheet and income statement. This summarized data is for the entire company as a whole, and is based on a historical performance by reporting on the past. Reliability is emphasized since information is used outside the company. Financial Accounting is driven by the rules of double entry accounting in which both sides of a transaction are entered – one debit and one credit. This keeps the books in balance. For example, the purchase of new equipment will be entered as an “increase to assets,” and also entered as a “decrease to cash or increase to debt.” Since accounting information is so important on making financial decisions, rules are established to ensure that people and organizations understand how accounting information is measured. In the USA, Generally Accepted Accounting Principles (GAAP) is the common standards that indicate how to report economic events. Following standardized rules also makes sure every asset and transaction is documented, each invoice and account is paid on time, nothing is paid more than once or left unpaid, keeps all financial matters under control, and reduces the chance of embezzlement. (Note: at least two employees should be involved anytime cash is expected to change hands).

The primary purpose for the financial accounting system is to be able to develop the needed financial statements, most commonly being the balance sheet and income statement, at the end of each month, quarter or year.

Managerial Accounting provides accounting information to internal parties for profit planning and budgeting, costs of an organizations products and services, and performance reports such as budget vs. actual results. These reports are for areas or departments of the organization and not the whole company. Analyzing the data from these reports are very useful for managers who direct, plan and control its day-to-day operations, to make decisions regarding the future. Managerial Accounting focuses on the future, rather than reporting on the past. Reporting on the past is the primary role of financial accounting. Because these reports are internal, and there are no regulations, it does not follow GAAP. The institute of Managerial Accounting sponsors the CMA (Certified Managerial Accountant) and developed the standards for ethical conduct, which are competence, confidentiality, integrity and objectivity.

Costing is also a major part of managerial accounting. Knowing the cost of goods to be sold is critical before planning for the future. Using a manufacturing company as an example, the elements that go into determining manufacturing costs are:

· Direct materials or raw materials, which include any materials that become an integral part of a finished product. It is a part of COGS as a direct cost of materials needed.

· Direct Labor costs, which are costs that can be physically traced to the actual production of the product. It is a part of COGS as a direct cost making the product.

· Manufacturing overhead, which encompasses all the costs that are not designated as direct material or direct labor such as the SG&A and indirect costs like the janitor who cleans the manufacturing warehouse, etc.

Numbers are the universal language of finance and are the raw materials of a balance sheet and income statement (or P&L – Profit and Loss - statement). We will discuss all of the major financial terms and their meanings within the balance sheet and income statement in the next two sections.

Financial Statements: The Balance Sheet

The balance sheet is often described as a “Snapshot” of the current company’s financial condition on a certain date. It shows the “Assets” on the left, or top, of the balance sheet, and the “Liabilities and Owners Equity” on the right, or bottom. The Assets must balance out with the Liabilities and Owners Equity. Assets are what a company owns, such as equipment, buildings and inventory. Claims on assets include liabilities and owners' equity. Liabilities are what a company owes, such as notes payable, trade accounts payable and bonds. Owners' Equity represents the claims of owners against the business. The formula is Assets = Liabilities + Owners’ Equity.

Example – The Balance Sheet. There are explanations for each item following the Balance Sheet. Click the links on the Balance Sheet to go directly to their explanations:

| Balance Sheet - Sample Corp. Fiscal Year (FY) 2007, 2008 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 12/31/2008 | 12/31/2007 | 12/31/2008 | 12/31/2007 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ASSETS | LIABILITIES | and OWNERS' EQUITY | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Current Assets | Current Liabilities | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash | $45,000 | $40,000 | Long-Term Debt – 1 Yr. | $12,000 | $11,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Marketable Securities | $65,000 | $60,000 | Notes Payable | $15,000 | $14,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Accounts Receivable | $85,000 | $70,000 | Accounts Payable | $13,000 | $12,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Notes Receivable | $45,000 | $40,000 | Taxes Payable | $11,000 | $10,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Inventories | $85,000 | $80,000 | Accrued Expenses | $21,000 | $20,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Current Assets | $325,000 | $290,000 | Other Current Liabilities | $10,000 | $9,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| $82,000 | $76,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Land | $85,000 | $80,000 | Long-Term Liabilities | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Buildings | $100,000 | $90,000 | Notes Payable | $30,000 | $27,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Machinery | $30,000 | $25,000 | Bonds Payable | $60,000 | $52,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| –Accumulated Depreciation | ($4,000) | ($3,500) |

| $90,000 | $79,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $211,000 | $191,500 | Other Liabilities | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Intangible Assets | Pension Obligations | $90,000 | $82,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Goodwill | $15,000 | $5,000 | Deferred Taxes | $70,000 | $62,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Patents | $20,000 | $19,000 | Minority Interest | $15,000 | $12,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trademarks | $15,500 | $13,400 |

| $175,000 | $156,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Copyrights | $24,000 | $22,900 |

| $347,000 | $311,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $74,500 | $60,300 | OWNERS' EQUITY | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other Assets | Preferred Stock | $60,000 | $50,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investments | $25,000 | $23,000 | Common Equity | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deferred Charges | $50,000 | $45,000 | Common Stock | $97,500 | $89,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $75,000 | $68,000 | Capital Surplus | $111,000 | $99,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $360,500 | $319,800 | Retained Earnings | $120,000 | $105,800 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| –Treasury Stock | ($50,000) | ($45,000) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Common Equity |

| $248,800 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $338,500 | $298,800 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Assets | $685,500 | $609,800 | Total Liabilities and Owners' Equity | $685,500 | $609,800 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Here is a brief explanation of the type of Assets, Liabilities, and Owners’ Equity associated with a common Balance Sheet:

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| LIABILITIES – which is everything the company owes, mostly to suppliers and creditors. Current liabilities are those payable within a year of the date of the balance sheet. Here are the most common types of liabilities: | Back | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Long-term debt, which is the debt due after one year of the date of the balance sheet. | Back | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Notes Payable, which are short-term borrowings that are payable within the year. It is a promissory note, which is basically a written promise to pay. | Back | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Accounts Payable, which is the amount the company owes to suppliers. | Back | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Federal income taxes, and when applicable city and state taxes. | Back | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Accrued Expenses Payable, which is all other monies, owed at the time of creating the balance sheet including employees, contractors, utilities, etc. | Back | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| I.e. Current portion of long-term debt, which is the amount due within a year from the date of the balance sheet. This would be considered a current liability. | Back | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Notes Payable, which are non current (due after 12 months) borrowings. It is a promissory note, which is basically a written promise to pay. | Back | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bonds payable, which is the obligation due on maturity of bonds. | Back | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pension obligations, which is the liability for future pension benefits due to employees. | Back | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deferred Taxes, which are the longer-term tax obligations that have been deferred to some future period. | Back | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Minority interest, which is the ownership of minority shareholders in the equity of consolidated subsidiaries. | Back | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| OWNERS' EQUITY (also known as Stockholders’ Equity - when applicable) – which is the amount left over for the company’s owners after the liabilities are subtracted from the assets. The formula is “Assets – Liabilities = Owners Equity.” This is also referred to as “Net Worth.” If the company is incorporated, they can issue stock. Stocks represent ownership in a corporation. A share of stock is one unit of ownership. Investors buy stock to share in the company’s profits, where as the company issues stocks to raise money from the investors. If the company is not incorporated, such as a Sole Proprietor, they will not have accounts for stock, but will invest the money back into the company through “Retained Earnings.” If this number is zero or negative, then the company is obviously in trouble and steps will need to be taken, or else there is the chance of bankruptcy. | Back | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Preferred Stock, which is a type of stock that pays a dividend. It is a payment from profit made to stockholders out of the company’s income at a specific rate, regardless on how the company performs. Owners of preferred stock do not have voting rights such as who should be on the Board of Directors or whether or not to sell the company. They only get dividends if the company has earnings to pay them. It is called preferred because the dividend must be paid before dividends are paid on the common stock. | Back | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common Stock, which the owners have voting rights, but do not receive dividends at a fixed price. The value of the stock can rise or fall. | Back | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Capital Surplus, also known as “additional paid-in capital,” is the amount paid to the company in excess of the par value. When a company issues a stock, the stock has a par value, a value assigned to a share of stock by the company. This value does not determine the selling price, or market value, of the stock. The selling price that the investor pays per share is determined in the market. | Back | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Retained Earnings, which is money reinvested into the company and becomes part of the capital that finances the company. | Back | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Treasury stock, which is stock in the company that has been repurchased and not retired. | Back | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

As you can see, the “Total Assets” for each year equaled the “Total Liabilities Equity.” It is called a “Balance Sheet” because it has to balance. Each dollar value was a “Snap-Shot” on the date of the financial statement. Assets are in order of their liquidity and how fast they can be converted into cash. Current assets are expected to be liquidated within one year of the date of the Balance Sheet. Liabilities and Equity are in order in which they are to be paid. Current Liabilities are payable within one year. Also, as you can see, there are two years of figures on the balance sheet for comparison and trending purposes.

Managers seeking to lead their department must learn to read between, above, and around the numbers to uncover two key indicators: proportion and direction.

Proportion: Your company’s financial reports reveal interesting and important information on the proportion of physical assets (plant and equipment) versus cash flow. This is important because the speed at which a company turns over its assets reveals how capital-intensive (requires large amounts of money) that business is. If you turn over assets quickly, you can afford low margins (profit) per sale. If you turn over assets slowly, you must earn a steep margin per sale. The key point here is if you turn over assets slowly, and earn little profit per sale, you will not be adequately profitable. It’s the proportion of cash flow versus physical assets on the balance sheet that tells you how hard you have to work those physical assets to make an adequate profit. The larger the investment in assets one has to make in a business in relation to sales, the greater the margin one needs to make on each sale.

Direction: A general sense of a company’s direction can be assessed from its financial statements. Sometimes relationships between a company’s resources and its sales growth get out of whack. If a company must invest a disproportionate amount of assets for each dollar of sales increase, then the company will be pouring extra money into its assets to such an extent that it will eventually run out of money. For example, if a company wants to grow by 20% on a sustainable basis, management must continue to add 20% to the retained earnings. This is reflected in the balance sheet in the shareholders equity. If shareholders equity grows by only 10% at a sustainable level, the company can grow by only 10% at a sustainable level. The only way to exceed 10% growth is to increase profitability or acquire additional debt (borrow more money). This is why it is so important to understand how to read the balance sheet so you can see a snapshot of the company’s direction.

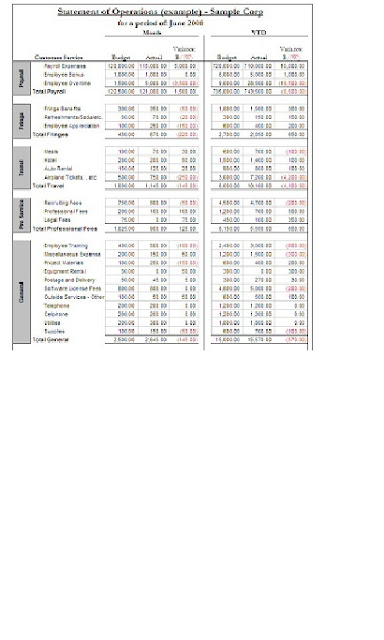

Financial Statements: The Income Statement

Income statements show the results of a company’s operations, which are usually given quarterly or by fiscal year. It shows the sales, also known as revenue, and expenses. It also shows whether the company had a profit or loss during that period. The Income Statement is also known as the “Profit & Loss” statement or “P&L.” Simply put, the formula is: “Revenue – Expenses = Income.” The easiest and best scenario is, “The higher the sales and the lower the expenses, the greater the income.” There are all types of expenses that are generated in a company and this statement sees how the company is spending its money, and how management is most and least effective.

As previously described, the Balance Sheet shows the value in the company’s accounts at a certain period, whereas the Income Statement covers operations over an entire period.

The income statement gives you the “Net Income,” also known as “The Bottom Line,” after all costs and expenses have been subtracted from all possible income including total sales, interest earned on investments, and sale of a non-tangible item like a patent.

Example – Income Statement. There are explanations for each item following the Income Statement. Click the links on the Income Statement to go directly to their explanations:

| Income Statement | |||

| Sample Corp. FY 2007, 2008 | |||

| Figures USD | 2008 | 2007 | |

| Sales (Revenue) | 15,500,000 | 14,625,000 | |

| Less: Cost of Goods Sold (COGS) | (9,900,000) | (10,500,000) | |

| Gross Income | 5,600,000 | 4,125,000 | |

| Less: Selling, General, Administrative Costs (SG&A) | (3,300,000) | (2,350,000) | |

| Operating Income Before Depreciation (EBITDA) | 2,300,000 | 1,775,000 | |

| Less: Depreciation, Amortization, Depletion | (11,000) | (10,000) | |

| Operating Income (EBIT) | 2,289,000 | 1,765,000 | |

| Less: Interest Expense | (93,000) | (89,000) | |

| Non-operating Income | 2,196,000 | 1,676,000 | |

| Less: Non-operating Expenses | (42,000) | (40,000) | |

| Pretax Accounting Income | 2,154,000 | 1,636,000 | |

| Less: Income Taxes | (1,350,000) | (1,240,000) | |

| Income Before Extraordinary Items | 804,000 | 396,000 | |

| Less: Preferred Stock Dividends | (87,000) | (85,000) | |

| Income Available for Common Stockholders | 717,000 | 311,000 | |

| Less: Extraordinary Items | (18,000) | (15,000) | |

| Less: Discontinued Operations | (400,000) | (100,000) | |

| Adjusted Net Income | 299,000 | 196,000 | |

| Earnings Per Share (200,000 shares of stock) | $1.50 | $0.98 | |

| Here is a brief explanation of the type of accounts associated with a common Income Statement: | |||

| Revenues – also called “Sales, “Sales Revenue,” or “Sales of Goods or Services.” It is also known as the “Top Line.” It is the amount of money the company made, before any expenses, on its operations. This, however, would not pertain to any income made from selling plant equipment or interest on marketable securities, etc. When applicable, income other than what is considered revenue is shown in “Other Income or Interest Income.” | Back | ||

| Cost of Goods Sold – also known as, and pronounced, “COGS” or “Cost of Sales” – These are direct costs or direct expenses because they are directly associated with making what the company sells (i.e. manufacturer), cost directly associated with the service the company supply’s (i.e. Internet Service Provider), or what a company would pay for merchandise it sells in stores (i.e. retailer). For example: | Back | ||

| |||

| Gross Income – also called “Gross Profit.” It is the money the company earns on its sales before SG&A. | Back | ||

| Selling, General, and Administrative Expense also known as “SG&A” – It is the salary of the sales people and the commissions, sales expenses, marketing expenses, managers salaries and benefits, office expenses like the power, lights, rent, supplies, and everything else needed to run a company. This also includes the cost of the supporting departments like HR, IS, Finance, etc. Basically SG&A is all costs that are not directly producing the product, or after a retailer buys a product from a supplier, as described in COGS above. | Back | ||

| Operating Income Before Depreciation - This is gross income or gross profit minus SG&A. This is also the EBITDA number. For more information on EBITDA, see the related ratio explanations later in this lesson. | Back | ||

| Depreciation Expense – This is the amount of depreciation charged against sales during the period. This is not the same as accumulated depreciation on the balance sheet, as that is the total of all past depreciation. This depreciation expense will be on the income statement, and also added to the accumulated depreciation on the balance sheet at the beginning of the period. | Back | ||