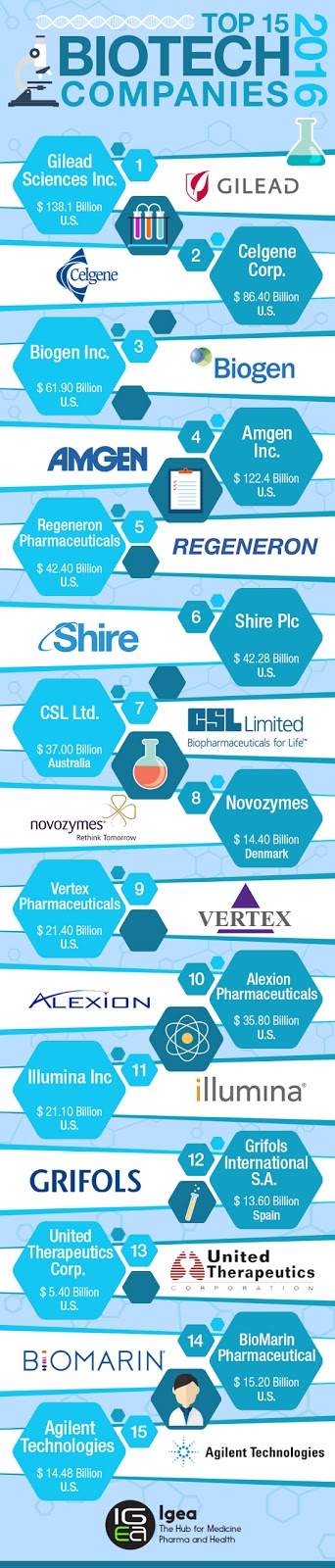

THE GLOBAL BIOTECHNOLOGY MARKET WAS ESTIMATED TO BE USD 330.3 BILLION IN 2015. THE MARKET IS GROWING AND THE TOP-15 BIOTECHNOLOGY PLAYERS ACCOUNT FOR A MARKET SHARE OF ~33% IN 2015. THESE ORGANIZATIONS ARE PRIMARILY LOCATED IN U.S. AND EUROPE. A COMPARATIVE ANALYSIS OF THE TOP 15 BIOTECHNOLOGY PLAYERS WAS DEVISED TO DEVELOP A RANKING FOR THESE ORGANIZATIONS. THE MODEL INCORPORATED EIGHT CRITERIA INCLUDING REVENUE, REVENUE GROWTH, OPERATING EXPENSE RATIO, INCOME PER SHARE, R&D BY SALES RATIO, INCOME PER EMPLOYEE, MARKET CAP AND ASSET TURNOVER RATIO. STATISTICAL SCORING WAS CONDUCTED BASED ON THESE CRITERIA TO ARRIVE AT THE FINAL SCORE BASED ON WHICH RANKS WERE DEVELOPED.

Analysis of top-15 biotechnology companies:

Sources: SEC filings, annual reports, Genetic Engineering & Biotechnology News and Forbes Media.

Sources: SEC filings, annual reports, Genetic Engineering & Biotechnology News and Forbes Media.

GILEAD SCIENCES INC. (U.S.)

Gilead is the top-ranked company in this list. The organization had highest revenues of USD 32,639 million in 2015. Income per share and income per employee is one of the highest for the company. Gilead also tops the market cap list in 2015. The operating expense ratio of the company is one of the lowest in 2015. The company manufactures research-based biopharmaceuticals with focus on human immunodeficiency virus (HIV), liver diseases such as chronic hepatitis C virus (HCV) infection and chronic hepatitis B virus (HBV) infection, oncology and inflammation, and serious cardiovascular and respiratory conditions.

CELGENE CORP. (U.S.)

Celgene ranks second in the list owing to its large revenue and high market cap. Another significant reason is the allocation of the high R&D budget in 2015. The company is engaged in the discovery, development and commercialization of therapies and treatment of cancer and inflammatory diseases through gene and protein regulation.

BIOGEN INC. (U.S.)

Biogen is the one of the largest company in terms of revenue and income per share in 2015. The company had asset turnover ratio of 55.20% in 2015. Biogen develops, markets and manufactures therapies for neurological, autoimmune and hematologic disorders.

AMGEN INC. (U.S.)

Amgen accounts for the second-largest revenue share of USD 21,662 million in 2015. The company’s income per share value was USD 9.15 in 2015. Amgen had one of the highest asset per share value in 2015. The primarily focus of the company is human therapeutics based on cellular and molecular biology.

REGENERON PHARMACEUTICALS, INC. (U.S.)

The revenue growth from 2014 to 2015 was 45.5% for Regeneron in 2015. The company also had one of the highest asset turnovers in 2015. The company is active in biopharmaceutical products marketing for eye diseases, colorectal cancer and a rare inflammatory conditions.

SHIRE, PLC (U.S.)

Shire had revenue of USD 6,416.70 million in 2015. The company had one of the lowest revenue growth of 6.5% from 2014 to 2015. The operating expense ratio was among the highest for the company calculated at 77.8%. The company focuses on therapies for rare diseases.

CSL LTD. (AUSTRALIA)

Australia-based company, CSL Ltd. accounts for one of the lowest operating expenses ratio at 27.98%. The asset turnover ratio of the company is the highest in 2015 and stands at 81.72%. The company develops, manufactures and markets vaccines, in vitro diagnostic products and plasma protein biotherapies.

NOVOZYME (DENMARK)

Novozyme is a Denmark based company and accounted for 95.1% of research and development to sales ratio in 2015. The company had one of the lowest income per employee in 2015. The company develops and produces industrial enzymes, microorganisms, and biopharmaceutical ingredients.

VERTEX PHARMACEUTICALS INC. (U.S.)

Vertex’s revenue for 2015 was one of the lowest but the company tops the list in revenue growth from 2014 to 2015 at 77.86%. The company had highest operating expense ratio at 145% resulting in low revenues. Furthermore, the company accounted for the highest R&D expenditure to sales ratio in 2015, measured at 96%. Vertex develops clinical development programs focused on cystic fibrosis, and has more than dozen ongoing research programs aimed life-threatening diseases.

ALEXION PHARMACEUTICALS INC. (U.S.)

The revenue for Alexion was USD 2,604.05 million in 2015. The company has lowest asset turnover ratio and one of the lowest income per share in 2015. The company had developed therapies for treatment of paroxysmal nocturnal hemoglobinuria and atypical hemolytic uremic syndrome and aims to develop enzyme replacement therapies for rare disorders.

ILLUMINA, INC. (U.S.)

Illumina’s revenues in 2015 were valued at USD 2,219.76 million. The company had one of the lowest expense ratio amongst others in 2015. Illumina develops, manufactures and markets systems for the analysis of genetic variation and function. It also provides sequencing and array-based solutions for genetic analysis, genotyping and whole-genome sequencing services.

GRIFOLS INTERNATIONAL, S.A. (SPAIN)

The revenue for the Spanish company was USD 4,167.88 million in 2015. Grifols had the lowest operating expense ratio in 2015, calculated at 24.6%. The company ranks 12th in the list owing to lowest R&D by sales ratio and income per employee in 2015. The company produces a variety of plasma derivatives.

UNITED THERAPEUTICS CORP. (U.S.)

United Therapeutics revenue was USD 1,465.76 million in 2015. The company had the lowest market cap in 2015. The company tops the list in income per employee category valued at USD 9.16 million. The company in engaged in development and commercialization of cardiovascular and infectious diseases and cancer treatment products.

BIOMARIN PHARMACEUTICAL INC. (U.S.)

BioMarine accounts for the lowest revenues and income (loss) per share value at USD 889.90 million and USD -1.07 in 2015. The company has one of the highest operating expense and lowest asset turnover ratios on 2015. BioMarine commercializes and produce therapies for mucopolysaccharidosis type I (MPS I) and phenylketonuria.

AGILENT TECHNOLOGIES (U.S.)

Agilent Technologies ranks lowest in the list owing to decline in revenue growth rate from 2014 to 2015. The company also had one of the lowest research and development budgets in 2015. Agilent is active in life sciences and diagnostics research in the field of cancer, cardiovascular diseases, diabetes, Alzheimer’s, Parkinson’s, and autism amongst others.

Sources: SEC filings, annual reports, Genetic Engineering & Biotechnology News and Forbes Media.

Sources: SEC filings, annual reports, Genetic Engineering & Biotechnology News and Forbes Media.