by Ben Adams

We all love a top 10: It serves as a definitive "best of the best," and sometimes a look at the top of the chart can reflect the state of an industry.

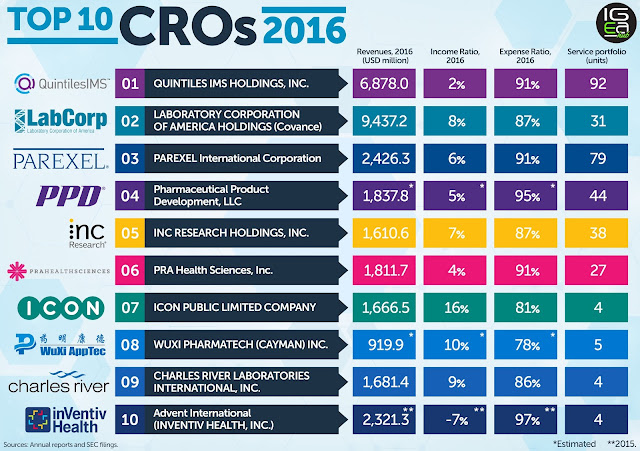

Looking back at our most-read stories shows our readers certainly like a broad range of news and features: This year, for the first time I believe, a CRO story topped our charts. It's indicative of the kind of noise the contract research industry has been making over the past few years.

Our top story, by a clear margin, was the merger of INC Research and inVentiv Health, making the pair worth around $7.4 billion in May when the deal was announced. This came around a year after Quintiles and IMS Health came together in their massive $19 billion megamerger, and at a time when Big Pharma-biotech deals have been a little sparse, to say the least.

The second largest story is less surprising, as it’s all about cuts and reorgs, and it was Shire’s change up that saw readers come to the site in tens of thousands. The biopharma said it wasn’t expecting any major staffing cuts, but closure of some sites are in the cards. This all comes after some big buys for the company, and an attempt to bring closer together its R&D operations.

The third was something of a theme in 2017: R&D “consolidation”, or in this case, GlaxoSmithKline’s new chief Emma Walmsley looking to make a statement in research by wielding the ax to dozens of pipeline meds and putting its rare disease work in the crosshairs.

Then we come to our special features: FierceBiotech’s Fierce 15 2017, and the top pharma R&D budgets for last year. This year’s crop of Fierce 15 ranged across cancer, rare disease and neuroscience, with all vying to be big hitters in the race to be a next-gen biomedical company.

The top pharma R&D budgets, meanwhile, saw Roche and Novartis top the list of big spenders, with the average top 10 pharma seeing 17% of its total revenue going into R&D, with a combined $70 billion being spent across the top 10. Stay tuned for our top ten early next year, and we’re already on the look out for the next crop of early-stage biotechs for Fierce 15 2018.

Our sixth most read story of 2017 was AbbVie’s positive phase 3 psoriasis data on its potential blockbuster risankizumab, scoring a big win against its own major blockbuster Humira, as well as Johnson & Johnson’s Stelara. AbbVie is gunning for other inflammation indications as it looks to try and head off some of the losses it will rack up from Humira biosimilars, with revenue expected from 2019.

Number seven centered on President Donald Trump’s potential NIH director pick Dr. Patrick Soon-Shiong, CEO of I-O biotech NantKwest, who was rumored to have been the best paid CEO in the world. In the end, this didn’t happen of course. In fact, Soon-Shiong had a pretty bad year after a series of investigations from healthcare news site STAT alleged that he donated millions of dollars to philanthropic causes, which later circled back to his company. A promotional video for one its pipeline meds also drew ridicule on Twitter.

Meanwhile, STAT’s senior writer Adam Feuerstein, via the power of the poll, named Soon-Shiong the worst biopharma CEO of 2017.

In at number eight was an unusual story about biotech Acerta, bought up by AstraZeneca, which it turns out faked some early preclinical data for its drug acalabrutinib. AstraZeneca admitted the falsification in the fall, after a story from Retraction Watch, blaming a “former Acerta employee who acted alone.”

This got a lot of views, but did not upset the apple cart for AZ, as acalabrutinib was in fact approved by the FDA just a few weeks later as Calquence for certain blood cancers.

Number nine was related to the drawn-out saga of Elizabeth Holmes and her beleaguered Theranos. We ran many stories on this for FierceMedTech, but the most viewed was the fact that it turned out Holmes was $25 million in debt to her own company. This was found out by the Wall Street Journal, which has spent years investigating the company.

And finally, we have the tenth most viewed story of 2017: The FDA’s rejection of Amgen and UCB’s application for approval of osteoporosis candidate romosozumab, coming off of a safety scare, notably on potential cardiovascular adverse events.

Check out your top 10 below:

- INC Research and inVentiv Health merge in another major CRO deal

- Shire will cut U.S. locations and move HQ in consolidation push

- GlaxoSmithKline stops development of 30 pipeline prospects, mulls sale of rare disease unit as new CEO Walmsley makes her mark

- FierceBiotech's 2017 Fierce 15

- The top 10 pharma R&D budgets in 2016

- AbbVie’s risankizumab blows away aging rivals in phase 3

- Donald Trump considers NantKwest CEO for NIH chief

- AstraZeneca buy Acerta faked cancer drug data, company admits

- WSJ: In a twist, Holmes owes Theranos $25M

- Safety scare prompts FDA to reject Amgen’s romosozumab