(Part 1 - cutt.ly/ow9rKBXR)

70+ business model examples in a nutshell

A mix of chain and franchise business model

Starbucks is a retail company that sells beverages (primarily consisting of coffee-related drinks) and food. In 2018, Starbucks had 52% of company-operated stores vs. 48% of licensed stores. The revenues for company-operated stores accounted for 80% of total revenues, thus making Starbucks a chain business model.

While McDonald’s makes money by primarily and heavily franchising its restaurants, Starbucks is a mix of operated vs. licensed stores. If we look at the revenue generation, company-operated stores make up 79% of the company’s revenues in 2017.

Ad-supported (subsidized) business model

On the other end, Spotify makes sure to support its free side of the business by running ads. Those ads, subsidize in part the free service for over 163 million accounts as of March 2020.

Therefore, instead of letting premium members support the free plans. The ad-supported side (representing 10% of its revenues as of 2019) becomes self-standing and viable.

In short, while the free/ad-supported side of the business is relevant to Spotify to convert those accounts in premium. At the same time, it works pretty well as a self-sustaining product tied into a digital business model.

However, as the ad-supported model scales, it also proses some threats to the scalability of the business model, as the licensing costs for the streamed content might grow quickly (Spotify will pay more royalties as more free users stream content on the platform).

That is also part of the transition of what I like to call from platform to brand.

Affiliate business model

Let’s say you have a website with a large amount of traffic each month. Yet you don’t sell any product or service, which is yours. How do you make money? Well, thanks to affiliate marketing you don’t need either a product or a service, you have many from other companies.

Thus, you’ll make money by merely featuring other products or services and getting a commission for that. Affiliate marketing done right can be a powerful source of income. Take, Pat Flynn from Smart Passive Income, which has been generating millions of dollars with affiliate marketing:

Aggregator business model

In this business model, the aggregator becomes the middleman by removing all the other middlemen from the market. To understand more about this model and how it differentiates from platform business models, read the guide on the aggregator business model.

Agency-based business model

neilpatel.com is one of the most successful sites in digital marketing. Neil Patel has also used his name as a brand, which has become recognized in the digital marketing space.

However, rather than selling tools or info products, Neil Patel is monetizing its traffic by generating leads for his digital agency. As he pointed out:

My model isn’t as scalable and it requires more headcount, but it can generate much more money. Just look at ad agencies like WPP and Dentsu. They generate billions in revenue!

Yet, the idea behind the agency-based business model is simple: you generate enough qualified leads, set up a lean team to manage those projects, and grow the agency based on on-coming projects! According to Neil Patel – at least in the digital marketing space – there is still space to grow a multi-billion turnover agency.

AIaaS business models

In the coming decade, every software company will be an AI company. And this trend is very very strong. Indeed the SaaS industry is already turning into an AI-based software industry. Thus, the AIaaS industry and its business models already turned into a multi-billion dollar industry:

Asymmetric business models

Each time you click through a link on Google that has the “ad” notation next to it. De facto you’re allowing Google to monetize on a keyword, while you’re making a business monetize on that keyword if you buy the service they provide.

A similar logic applies to Facebook. The news feed is the place where Facebook monetizes most of its ads. Both models both use a hidden revenue generation model as those services work so well that most users barely realize their data is getting sold for advertising.

Attention merchant business model

An attention merchant might be defined as a company that primarily makes money by harvesting human attention. While this definition is tough in practice (most companies make money by grabbing their target attention) the attention merchant’s primary asset is human attention.

That is also why companies operating with an advertising business model are defined, as attention merchants. While in the tech industry companies like Facebook and Google have become hugely profitable by using an advertising model.

While Google and Facebook proved to have a solid business model, attention merchants usually also face many challenges. In fact, as those companies scale up, they also end up grabbing the attention of billions of people worldwide. When that happens, those tools become a threat to the political system which tries to kick back by regulating or fining them.

Another aspect of attention merchants is about keeping the users hooked. When those apps start losing users’ attention – if they don’t have a solid business model – a single Tweet from a Kardashian can make the company burn over a billion dollars in market cap!

sooo does anyone else not open Snapchat anymore? Or is it just me… ugh this is so sad.

— Kylie Jenner (@KylieJenner) February 21, 2018

Barbell business model

And on the other end, the remaining part of the capital is invested in extremely aggressive strategies with massive potential upsides, yet controlled downsides. In short, you make yourself prone to take advantage of positive Black Swans (rare events that can benefit you).

I want to take this further to apply that to business modeling. Here the company uses a barbell approach to product and distribution. You have a core product and business where most resources are spent and the whole organization is structured around. On the other end, you place bets on new products that might renew your business model and make the old irrelevant.

An example of that is how companies like Google, keep investing most resources in their core business model while also placing other bets, prone to create not only a whole new business model but whole new industries.

Bidding multi-brand platform model

Grubhub is an extremely interesting case as the Company primarily charges restaurant partners a per-order commission (mostly percentage-based). The restaurants can choose (in most cases) their level of commission rate, at

or above the base rate.

When a restaurant pays a higher rate, that positively affects its prominence and exposure to diners on the Platform. This approach combined with Grubhub’s brands enables restaurants to easily build up their delivery operations even if they lack that.

Thus, increasing the overall market value, as more restaurants can supply their food and people get more variety.

Blitzscaler-mode business model

That applies to the consumer e-commerce side of Amazon (excluding Amazon AWS) where the company, while generating low-profit margins for years, also generated substantial cash flows that it invested back to massive growth. A sort of continuous blitzscaler-mode, that while risky for most companies, has become a normal mode for Amazon. Thus, Amazon has been able to ingrain blitzscaling within its business model.

Blockchain-based business models

Merely put the Blockchain is a distributed ledger that relies on cryptography to handle transactions, interactions, or anything that implies an exchange between people, which is decentralized and anonymous.

That was a revolution. Since Bitcoin has become a global phenomenon, the technology that allows it to function, the Blockchain, has been evolving. To be sure, the Bitcoin Blockchain isn’t the only protocol.

Large numbers of Blockchain protocols have been created since the Bitcoin launch. This means that the combination of existing business and new Blockchain protocols will give rise to a countless number of innovative business models.

Those few that will pass the test of time might probably give rise to the next Blockchain Giants. A compelling case of innovation based on a Blockchain-based business model is Steemit:

| Ethereum | Proof of Work (ETH 1.0), switching to Proof of Stake (ETH 2.0). A Proof of Stake (PoS) is a form of consensus algorithm used to achieve agreement across a distributed network. As such it is, together with Proof of Work, among the key consensus algorithms for Blockchain protocols (like Ethereum’s Casper protocol). Proof of Stake has the advantage of security, reduced risk of centralization, and energy efficiency. | Ethereum was launched in 2015 with its cryptocurrency, Ether, as an open-source, blockchain-based, decentralized platform software. Smart contracts are enabled, and Distributed Applications (dApps) get built without downtime or third-party disturbance. It also helps developers build and publish applications as it is also a programming language running on a blockchain. |

| Ethereum [The Graph] | ERC-20 Utility Token: Ethereum as the underlying protocol. An ERC-20 Token stands for “Ethereum Request for Comments,” a standard built on top of Ethereum to enable other tokens to be issued. Based on a smart contract that determines its rules, the ERC-20 enables anyone to issue tokens on top of Ethereum. As they are using a standard, those are interoperable. ERC-20 Tokens are critical to understanding the development of Ethereum as a business platform. Utility Tokens enable users’ participation in the network. Thus they work as a sort of built-in incentive mechanism for users to help the network grow. | The Graph is an ERC20 Utility Token (built on top of Ethereum) to enable consumers to freely query the blockchain through a fully decentralized database kept by indexers, incentivized by the payment of tokens (called GRT). The network is also ministered by curators and delegators that help maintain a high-quality index. |

| Ethereum [BAT – Brave] | Brave is an open-source, privacy-centric web browser developed by Brave Software Inc. The company was founded by Brian Bondy and Brendan Eich in 2015. Brave makes the bulk of its revenue through banner advertising. In a rather unique arrangement, Brave users take 70% of the advertising revenue with the company taking the remaining 30%. Brave sells subscriptions to its video conferencing, VPN, and firewall products. It also makes money through affiliate commissions and merchandise sales in its decentralized web store. | |

| Arbitrum Layer 2 Leveraging Ethereum’s protocol | A layer 2 solution can be applied as an additional protocol layer to solve various issues that the primary protocol can’t handle at scale. For instance, when it comes to Ethereum, when too many transactions go through the primary protocol, they can hardly go through, thus slowing down the main Ethereum protocol and making it not usable. In the case of Arbitrum, this works as a Layer 2 scaling solution. Meaning it helps manage transactions on top of this extra layer to help further scale the volume of transactions handled by the main protocol. Arbitrum works as the middle layer for various applications. For instance, Uniswap decentralized exchange is also, in part, relying on Arbitrum to scale the transactions that go through Uniswap. | One of the most popular Ethereum scaling solutions, Arbitrum aims to speed up transaction times and cut fees on the Ethereum blockchain |

| Uniswap leveraging the Ethereum protocol | Uniswap is a decentralized exchange that enables users to exchange any ERC-20 token and more. Uniswap is a DeFi application and protocol which sits on top of Ethereum’s main protocol, and it leverages two Layer 2 scaling solutions (Optimistic Ethereum & Arbtrum). These underlying scaling solutions enable many transactions to go through the platform smoothly. When looking at Uniswap, it’s essential to distinguish between Uniswap as a token (which allows crypto users to exchange the UNI token) and Uniswap. This decentralized platform sits on top of Ethereum and leverages Optimistic Ethereum & Arbtrum to enable millions of transactions on top of the platform. | Uniswap is a decentralized cryptocurrency exchange founded by former Siemens mechanical engineer Hayden Adams in 2018. The exchange utilizes an automated market-making system rather than a traditional order book for transactions on the Ethereum blockchain. |

| Axie Infinity Leveraging Ethereum’s protocol | Axie Infinity is a Non-fungible token (NFT). NFTs are cryptographic tokens that represent something unique. Non-fungible assets are those that are not mutually interchangeable. non-fungible tokens contain identifying information that makes them unique. | Axie Infinity is an NFT-based online video game developed by Sky Mavis, a Vietnamese game studio founded by Trung Nguyen in 2018. Nguyen combined his interest in blockchain accountability and the CryptoKitties craze to launch the game in August 2018. Sky Mavis generates the bulk of its revenue via the 4.25% fee it charges on all in-game purchases. This includes land purchases, monster NFT trading, and monster breeding. Axie Infinity requires that all new players purchase three monsters to get started. Since the cost can run into hundreds of dollars, Sky Mavis will lend players the monsters and collect a 30% interest fee once the player starts earning currency. |

Bundler model

In bundling, a strong distribution power combines several products in a single offer to extract more from the market. For decades Microsoft has been able to bundle several products under the same umbrella (Office has been coupled from time to time with several other products) so the company extracts more from the market, or if it were selling a single product.

Cash conversion cycle or cash machine model

Have ever wondered how some businesses survive, nonetheless the thin margin they have? One great example is Amazon.

A company that makes a low-profit margin yet it has been very disruptive. In reality, Amazon can get its partners to finance the business by playing on the short-term liquidity of the business.

Cloud-as-a-service (CaaS) business models

Cloud-based services have become the new standard. As the software paradigm has shifted from proprietary, to hosted, agile, and continuously improving, updating, and integrating within the company’s architecture, cloud-as-a-service business models (IaaS, PaaS, and SaaS), have become the new standard of the software industry.

The discount business model focuses on high quality

How? With several strategies. For instance, ALDI limits its stores to 1,300 items, which generates minimum waste. Also, ALDI also features its brands, which makes it inexpensive to sell them, as there will be lower sales and marketing costs associated. 90% of ALDI brands have an exclusive agreement with the market chain!

Distribution based business model

A distribution-based business model is one in which a company’s survival depends on its ability to have one or a few key distribution channels to connect to its final user or customer.

It is important to notice that almost any business can be classified as a distribution-based business model, as there is no company that can survive without distribution.

However, in general, companies that tap into consumer markets need to be extremely good at creating distribution channels that are able to unlock long-term value. There are a few critical aspects:

- The distribution channel has to be sustainable: this means that if you spend more money to maintain it that is what it generates might not work. It is fine in the short term to lose money on building up a distribution strategy. Yet in the medium term, it needs to be sustainable.

- It needs to be diversified: relying on a single distribution channel might be too risky, especially if you don’t control it. Therefore, it is critical to focus on the main channel, yet the company needs to expand and tap into other channels.

- It needs to scale: a distribution strategy is as good as its ability to stick also when the business scales up. Thus, the critical question is “would this strategy work if I go from €1 million to €10 million in revenues?” Many won’t and it’s fine. Yet as an entrepreneur, your goal should be to find a distribution strategy that scales.

Also, tech giants like Google spent billions to guarantee proper distribution. For instance, Google spends a good chunk of its revenues on distribution via acquiring traffic from several sources:

Direct-to-consumers business model

A direct-to-consumer business model is primarily based on direct access from a brand or company to its final customers. Indeed, the more a company is able to tap into its customers without the need of an intermediary, the more this model will work in favor of the brand, which is able to control the perception of its customers via massive marketing campaigns.

Indeed, this kind of model implies a massive activity of branding and marketing to make sure consumers have your product on top of their minds. A successful example of a direct-to-consumer business model is Unilever:

Indeed, consumer products have a low pricing point. Thus, to make sure to generate enough revenues for the company, marketing activities will be the key ingredient.

Direct sales business model

Nowadays, with the advent of AI, machine learning, and a new form of advanced technologies, it might seem demode to talk about direct sales. In fact, for many, this is a thing of the past.

However, the opposite is true. In an era where everything is getting automated the personal touch is becoming critical. Of course, once technology produces machines to the point of seeming human (see the Google Duplex experiment) that might be a different story.

Yet as of now, companies like ConvertKit use direct sales as a powerful weapon to grow their business, fast! Below you can see a simple Trello board put up by Nathan Berry, founder of ConvertKit when he decided to create a mail marketing tool from scratch just to see it grow to over a million dollars in monthly recurring revenue in only six years:

If you try to sell your service or product to anyone, this is more spamming. The more you qualify your audience, the more you create value.

E-commerce marketplace business model

When it comes to the Chinese industry, Alibaba is the market leader! In 2016 the company recorded over 423 million active buyers. Alibaba, just like Amazon has a diversified business model, with many moving parts. However, as of 2017 most of its revenues still came from core commerce.

As building up a website and e-commerce has become inexpensive, and it buries no particular cost for the traditional brick-and-mortar business, more and more small businesses join in and make the marketplace their primary source of revenue following Amazon’s leadership at the global scale. In fact, in many cases brick-and-mortar stores opt to become Amazon sellers:

In fact, by becoming a seller on Amazon, you allow your products to be directly picked, packed and shipped. Amazon takes a cut of the revenue, and the seller retains the rest. As Amazon puts it:

We offer programs that enable sellers to grow their businesses, sell their products on our websites and their own branded websites, and fulfill orders through us. We are not the seller of record in these transactions. We earn fixed fees, a percentage of sales, per-unit activity fees, interest, or some combination thereof, for our seller programs.

As of 2021 Amazon still made most of its revenues from retail products.

Educational niche business model

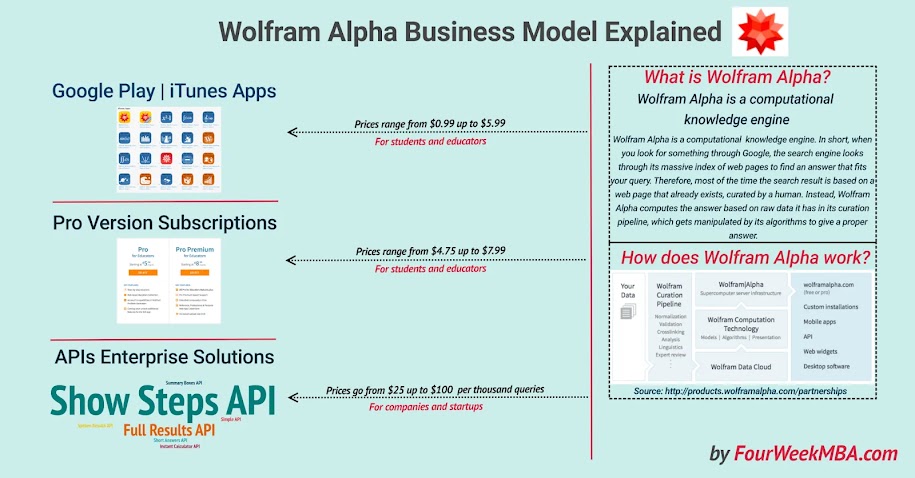

Built by one of the smartest persons on earth (Stephen Wolfram), Wolfram Alpha is a computational engine, able to provide complex mathematical questions and way more advanced (at least until a few years ago) compared to any other search engine.

Wolfram Alpha has built its business based on education. The primary targets remain students or teachers, which with a subscription can get unlimited access to Wolfram Alpha features.

Wolfram Alpha makes its computational engine free and open to anyone. Yet to get advanced features (such as full mathematical procedures) you will need to subscribe to the paid version. In short, that is a mixture of a freemium and subscription-based model that targets the educational industry.

Family-owned integrated business model

The family-owned integrated model starts from the assumption that even if you’ve built a multi-billion dollar company you can control it in its entirety, while you also keep an agile decision-making process based on an ownership structure that keeps the control of the organization in the hands of the family.

An example of that is the Prada business model:

Source: Prada annual report for 2017

They’ve also managed to keep the ownership of the firm in the hands of its two founders and partners in life, Miuccia Prada and Patrizio Bertelli:

With 100% of Prada Holding, the couple controls 80% of Prada! Their word is law within the organization. Although Prada as a multinational has complex management systems, Miuccia Prada and Patrizio Bertelli are the key decision-makers on strategic initiatives.

Feeding model

As platforms arise, they create ecosystems, becoming unexplored markets. Those markets can be surfed by feeding your business model on top of that. A good example is how HyreCar feeds its business model on top of Lyft and Uber networks of drivers.

People that want to make some extra bucks can rent temporarily a car and connect to Lyft and Uber to generate some extra income. In a sort of “tit for tat” relationship HyreCar “cooperates” and surfs the drivers’ network of Uber and Lyft, to create more liquidity, by making more cars available on the road for drivers, thus improving the supply, and therefore generating more demand.

Franchising business models

We’ve already mentioned here a couple of franchising business models, however, it’s worth having an overview of how these evolved over the years.

From the FourWeekMBA research, we identified three primary franchising models:

- Heavy-franchised: where franchisees own the business operations, but the franchisor controls the land development and the lease, as a tweak to control the standards followed by franchisees over the franchising operations (McDonald’s).

- Heavy-chained: where the franchising company takes care of the investment and costs to open a new unit, yet the company also takes higher royalties and profits get split up (Chick-fil-A).

- And franchained (or reverse franchained): in a franchained model, a company leverages the ownership model to establish new operations. Once established, the company reverts back to franchising. This model is extremely suited for those operations that require extreme expertise and leverage on the company’s scale to open up new markets (Coca-Cola). In a reverse franchained model instead, the company leverages the franchising model in the short, and it reverts back to an ownership model in the long run. This is extremely suited to quickly testing new markets, by increasing speed and reducing the cost of growth. For the model to work, there must be built-in incentives for the franchisee to sell back the operations at a premium, if they turn out successful.

Franchained and reverse franchained

Freemium model (freemium as a growth tool)

Free can be a powerful weapon for growth. Many in the tech industry and more specifically in the SaaS business model use Freemium to grow their business. The freemium is a mix of free and paid services.

The company offers a basic version of the product that works just like the premium product but it either has limited usage, or it has limited features. Thus, the free version is used for lead generation (capture contacts of people) and invite them to upgrade to the paid version or have the users with a free account to advertise their product.

Take SumoMe, a tool that allows you t grow the audience of a blog through newsletter forms, pop-ups, A/B tests, and heat maps:

If you get the freemium version of the tool, you still have a lot of features for free. SumoMe will invite you to upgrade over time, and it will show a small link “powered by SumoMe.”In short, the free product can be leveraged in several ways. First, for lead generation. Second, as a way to trigger upsells for non-paying customers.

Third, as a virality tool, with CTAs and links placed in strategic places to have free publicity from non-paying users.

If appropriately implemented the freemium model can be a great way to grow a brand and a business fast.

While freemium can be considered in certain circumstances a key element of a business model, it influences all its aspects. In many other cases, a freemium model is a growth tool that has an incredible potential in spreading the brand of the company offering it.

Companies like MailChimp and Slack, have strengthened their brands and marketing funnels by leveraging the freemium model.

Free-to-play model

The free-to-play model has become widely adopted in the gaming industry. Where companies like Microsoft and Sony sold their consoles at cost (Xbox and PlayStation) with a locked-in logic (gamers could not play in teams across those consoles) as they made money primarily by selling games.

Epic Games with Fortnite flipped this model. It made the game free, and up-sold products within the game.

Fortnite isn’t just a traditional freemium model, which we usually find in the software world. It had three modes of consumption, which helped shape its overall business model:

- Save the World, premium model: built as a player vs environment game, is structured as a mission-based game. Contrary to the Battle Royal mode, which is the one that enabled Fortnite success, Save the World is available at $14.99.

- Battle Royale, free-to-play model: built as a Player versus Player, or PvP, game mode this free-to-play game sparked virality and made Fortnite the success it is today. This game mode enabled up to 100 players, to play in several formats, alone, in duos, in squads, and more. The built-in group dynamics, and the fact it was freely available, helped sparkle the Epic Games’ ecosystem. And it is also lucrative for the company, as gamers can buy V-Bucks (Fortnite’s virtual currency) to customize their characters or else.

- Creative mode: in the Creative mode, players gain access to a private island, where they can design the whole thing as they want and invite others. This mode is pretty interesting as it enables not only gamers but also creators or aspiring so to build their own gaming environment.

Freeterprise model

As consumer brands showed the freemium model could be both a great go-to-market strategy and generate a continuous flow of qualified leads (however, only after the whole organization would be organized around identifying those opportunities), other B2B/Enterprise companies (those primarily selling to other companies or larger corporations) also mastered the freemium model but on a B2B scale.

That is why I like to call that “Freeterprise.” Companies like Slack and Zoom are great examples of how you can build a valuable business with a Freeterprise model.

This sort of looks like magic, as you can start from a single free professional account, and pull a whole organization into that, to transform it into an enterprise

As I explained in the Zoom business model though, the whole organization needs to be structured around the freeterprise model, where on the one end the company seamlessly uses the free product as an entry point within companies.

And on the other end, salespeople with the ability to build a strong relationship with the account can get the whole company on board, thus transforming a free professional account into a potential enterprise customer.

Of course, this leads the organization to skew its resources toward building an army of qualified salespeople to handle the volume of leads generated by the free offering (in 2019 Zoom spent 54% of its revenues primarily in salespeople headcounts).

Gatekeeper model

In the gatekeepers’ era, the market has been unified, and as such, it has become much bigger, yet the single middleman (the gatekeeper) is also the one who locked the distribution pipelines, thus retaining control over the access to millions of consumers.

Thus, the whole gatekeeper business model is about becoming the unlocker to final customers for millions of small businesses.

Heavy-franchised business model

The franchising business model is quite effective for the expansion of the organization. A franchisor licenses its know-how (which might comprise procedures, training materials, brand, and more) for a franchisee, which has the right to sell the franchisor products and services in exchange for a royalty. In some cases, the franchisor also gets a percentage of the revenues.

Humanist enterprise business model

The most prominent advocate for the humanist enterprise business model is Brunello Cucinelli. Indeed, Brunello Cucinelli business model is based on three key pillars:

- Italian Craftsmanship,

- Sustainable Growth,

- and Exclusive Positioning and Distribution.

The company generated over €503 million in 2017:

The humanist enterprise is based on the premise that “profit is made without harm or offense to anyone, and part of it is set aside for any initiative that can really improve the condition of human life: services, schools, places of worship, and cultural heritage.”

EdTech: enhanced education through digitalization ad tech platforms

EdTech is the attempt to make education more effective by leveraging on digital and tech. Several players are tackling this problem in different ways. Below are some examples.

For instance, the Udemy business model is trying to make everyone an instructor.

Duolingo’s business model instead leverages gamification to have millions of users learn any language:

Enterprise business model built on complex sales

In an enterprise business model, a company focuses on large clients, usually Fortune 500 clients that have a massive budget of millions or billions of dollars. This kind of business is primarily based on complex sales.

As Peter Thiel explains in his book Zero to One, when it comes to a company’s distribution it is critical to understand where you stand. Indeed, in an enterprise business model, it’s all based on closing large deals.Therefore, it is crucial to have senior salespeople with competence in managing those large deals to guarantee the success of the company.

In this respect, drawing a clear line between Marketing and Sales is the key point when trying to build up an enterprise business. That’s because you need to identify the right target with a laser focus.

Most of the time a large enterprise business might have only a few dozens of potential clients. Once identified those potential clients you need to put the proper resources to close those deals.

https://bitly.ws/3gw6d

Комментариев нет:

Отправить комментарий